|

SUNDAY EDITION May 11th, 2025 |

|

Home :: Archives :: Contact |

|

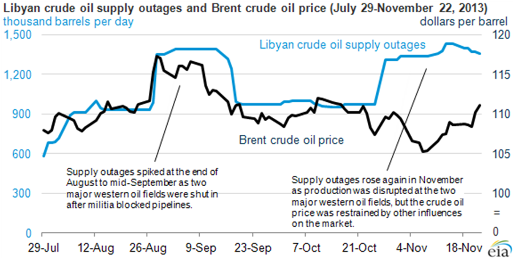

Four Countries that Could Send Oil Prices UpWritten by Nicholas Cunningham With shale oil surging in the United States, sometimes we in the West forget how much we depend on some politically wobbly countries to meet global demand. Oil markets are extremely tight, so it only takes one or two of them to get oil markets into a tizzy. As of this writing, there are four important oil producers that are literally at the brink of disaster. These four countries could seriously rattle oil markets: Venezuela. The South American country has the largest oil reserves in the world – yes, that’s right, more than Saudi Arabia – but it has punched way below its weight in terms of being a global energy player. Mismanagement, underinvestment, and outright corruption have plagued Petróleos de Venezuela (PDVSA), the state-owned oil company. It was long used as a piggy bank for social programs by the late Hugo Chavez. With revenues pillaged by the government, PDVSA has failed to raise oil production over the last twenty years, despite the rapid rise in oil demand and prices. In 1994, Venezuela was pumping 2.7 million barrels per day (bpd); by late 2013 that figure reached only 2.4 million bpd. This is a major problem for a government that relies upon PDVSA for 96% of its foreign exchange. The flagging oil sector is a major reason behind the state’s shaky finances. Deteriorating security, an inflation rate that has topped 56%, and shortages of basic goods like toilet paper and cooking oil have made the public wary. But it erupted into intense protest in mid-February. Opposition leader Leopoldo Lopez has led tens of thousands of protesters in demonstrations denouncing President Nicolas Maduro. Lopez’s support for a coup against Chavez in 2002 hasn’t gone unnoticed by the Venezuelan President. Maduro is cracking down, putting Lopez on trial for “terrorism,” and blaming him and other “fascists” for the country’s problems. This apparently extends to the U.S. as well, and on February 17, Maduro kicked out American diplomats. Maduro’s problems are reaching a crisis point, and jailing the opposition won’t help. It can’t pay its debt, airlines are cutting off flights to Venezuela, the currency is spiraling out of control, and public unrest is growing. Several people were already killed during protests. An escalation of violence is entirely possible. If so, the big question is what happens to Venezuela’s oil production. Best case scenario for oil markets is that the country doesn’t tear apart and PDVSA simply bleeds, with production gradually declining. The worst case is much worse, with violence knocking out production suddenly. Losing over 2 million bpd of global production – including 800,000 bpd of exports to the U.S. – would dramatically raise global prices. Iraq. Now the second largest producer in OPEC, Iraq is becoming a major oil player. But it is also descending into chaos. Oil exports were down to 2.2 million bpd in January from 2.34 million bpd a month before, in part due to sabotage by militants. Now the mainstream media is reporting that Iraq is working with Iran to challenge Saudi Arabia for control over OPEC. Not only is that far-fetched, but it is highly unlikely that Iraq will ever be able to get to 9 million bpd – the world is pinning too many hopes on a country that is mired in violence. And that’s the real story here for the short-term. Iraq suffered its most violent year in 2013 over the past six, with over 9,000 dead. Since the new year things have only gotten worse. On February 18 alone, at least 49 people were killed in a series of car bombs in and around Baghdad. Deputy Prime Minister for Energy Hussain al-Shahristani has warned that militant groups, perhaps spilling over from Syria, pose a threat to Iraq’s ability to export oil. “The attacks have been focused on oil export pipelines, power generation and transmission lines,” he said in late January, according to Reuters. He went on, "the Iraqi Turkish pipeline was blown up 54 times during 2013, averaging once a week yet we managed to repair and use that pipeline and pump on average 250,000 barrels per day last year." The central government also needs to resolve its conflict with Kurdistan, which is moving to export oil on its own terms. Kurdistan has connected a pipeline to the main line to Turkey, and has promised to begin exports soon. Baghdad is threatening to cut off financial assistance to the semi-autonomous region. No one knows where this one is going but suffice it to say, uncertainty will add a bit of a risk premium to oil for traders. Libya. It seems like we are bouncing from one dysfunctional OPEC-member to the next. The Libyan revolution in 2011 knocked its 1.8 million bpd entirely offline, leading to dramatic price spikes on the world market – Brent prices jumped 20% between February and April 2011. Libya seemed to regain its footing in 2012 and resumed production, almost to its pre-civil war days. Militias, which hold great power in the country, have seized oil fields in the east. Disputes with the national government cut off the flow of oil last fall. Oil production for January was only half a million bpd. But the situation darkened in the middle of February, when two militias called on the Parliament to step down. A political crisis is emerging, threatening to completely cut off the remaining trickle of oil. South Sudan. Renewed violence in South Sudan threatens this fourth oil producer. Rebels in South Sudan attacked Malakal on February 18, the capital of the country’s largest oil producing state, Upper Nile State. Both rebels and government forces blame one another for shattering the fragile ceasefire, which had been held together in recent weeks. But the latest unrest has a good chance of cutting off oil exports. Now, admittedly, global markets have not come to expect much from South Sudan, as it hasn’t successfully turned its vast reserves into meaningful production. But, the estimated 220,000 to 240,000 barrels per day that the country does produce is in jeopardy. So what does all of this mean? It’s not as if all four of these countries are going to cut off their oil production tomorrow, but neither is it likely that all four return to stability and rising production. Iraq may be the outlier here, as it seems the most stable of the four (which is saying something), but there is a good chance that meaningful production from some of these countries will be removed from global supply. Let’s look at what they mean to global oil markets. Taken together, these four countries represent roughly 7 million bpd of production when they are not in acute crisis. I’m assuming 2.4 million bpd for Venezuela, 2.9 million bpd for Iraq, 1.5 million bpd for Libya, and 240,000 for South Sudan. Even accounting for the loss of 1 million bpd from Libya since last year, which the markets have already factored in, we still have 6 million bpd at risk. So that is 6 million bpd that are looking pretty uncertain in the immediate future out of a global total of around 90 million bpd. What would happen if some of that was knocked offline? Obviously prices would spike, but it is hard to know how exactly markets will react. EIA estimates that the loss of 400,000 barrels from Libya last August led to a $9 per barrel increase in Brent prices. That gives us a sense of how finicky markets can be: less than 1% of oil went offline, and prices spiked about 8.5%. It doesn’t take much. We could expect a similar price spike if the political situation in the four selected countries takes a turn for the worse.

The other big unknown factor is how Saudi Arabia reacts. It acts a swing producer, and can compensate for lost production. But global spare capacity – the entirety of slack production around the world – stood at only 2 million bpd for the fourth quarter of 2013, almost the lowest in the post-financial crisis era. The only quarter with lower spare capacity was the prior one. In conclusion, Venezuela, Iraq, Libya, and South Sudan pose a threat to oil markets. They represent 6 million bpd of oil production currently online but at serious risk. While it is a fool’s game to predict the exact amount of oil production that could offline in the event these countries deteriorate, I do predict that a non-trivial amount of oil will be cut off by springtime. That’s not much to go on, but it’s enough to conclude that oil prices are going up. Written by Nicholas Cunningham |

| Home :: Archives :: Contact |

SUNDAY EDITION May 11th, 2025 © 2025 321energy.com |

|