Crude Oil Rally Should Carry into 2007

- Stocks are Leading the Way -

from ChartWorks:: published by

Institutional Advisors

Bob Hoye

Technical observations of RossClark@shaw.ca

December 2nd, 2006

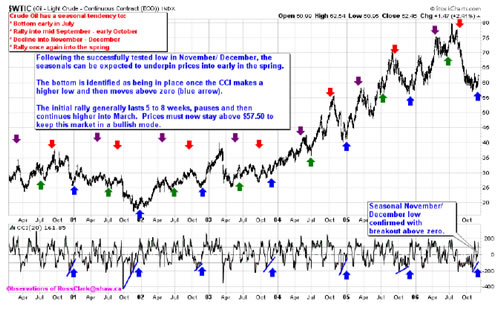

The seasonal low in Crude Oil appears to be in place. The higher low in the CCI(20) index followed by a move through zero should be the precursor to a five to eight week rally, a pause and then a continuation to the upside into March-April.

Since 1983, the level of the lower Keltner Band has provided a major support once the 50-week moving average was violated. The ensuing rallies have managed to retrace 50% or marginally more of the break since the last rally above the upper Keltner Band. The failed rally into August 11th ($77.70) becomes our measuring point for the current retracement. We can assume that the initial rally will carry to $67, but not beyond $70.

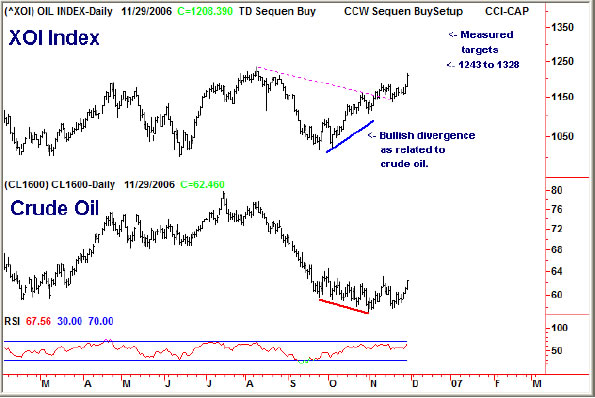

As noted on November 21st, the oil stocks were already putting in higher lows, creating a bullish divergence and ready to pop.

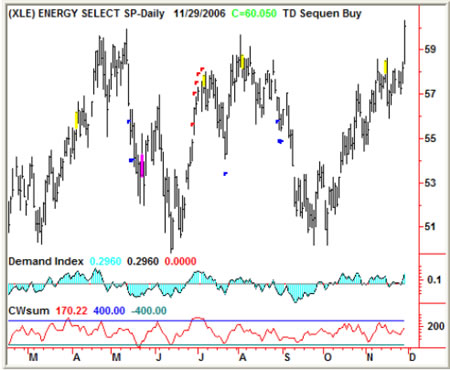

Three tradable indices are showing good strength

Canadian Energy iShares (XEG.TO)

OIH

XLE

Many of the energy stocks are moving through their resistance levels on expanding volume. Here are the individual ones that jumped out in our observations tonight and are showing leadership.

The opinions in this report are solely those of the author. The information herein was obtained from various sources; however we do not guarantee its accuracy or completeness. This research report is prepared for general circulation and is circulated for general information only. It does not have regard to the specific investment objectives, financial situation and the particular needs of any specific person who may receive this report. Investors should seek financial advice regarding the appropriateness of investing in any securities or investment strategies discussed or recommended in this report and should understand that statements regarding future prospects may not be realized. Investors should note that income from such securities, if any, may fluctuate and that each security’s price or value may rise or fall. Accordingly, investors may receive back less than originally invested. Past performance is not necessarily a guide to future performance.

Neither the information nor any opinion expressed constitutes an offer to buy or sell any securities or options or futures contracts. Foreign currency rates of exchange may adversely affect the value, price or income of any security or related investment mentioned in this report. In addition, investors in securities such as ADRs, whose values are influenced by the currency of the underlying security, effectively assume currency risk.

Moreover, from time to time, members of the Institutional Advisors team may be long or short positions discussed in our publications.

Bob Hoye

December 2nd, 2006

EMAIL:: bobhoye@institutionaladvisors.com

CHARTWORKS WEBSITE:: www.institutionaladvisors.com