|

SUNDAY EDITION May 11th, 2025 |

|

Home :: Archives :: Contact |

|

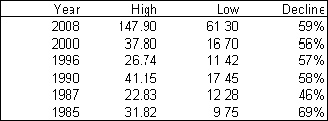

ChartWorksPUBLISHED BY INSTITUTIONAL ADVISORS WEDNESDAY, NOVEMBER 5TH, 2008 Technical observations of RossClark@shaw.ca Capitulations Abound The Capitulation/Exhaustion model was designed to identify times when markets are significantly overextended and susceptible to a price reversal. It can be employed in all time frames; interday, daily, weekly and monthly. While markets may be ready for a reversal based upon the alerts, investors should look for some sign of confirmation in price action or a change in volume characteristics to assist in the timing of the reversal. Last week’s daily alerts in the US Dollar, Euro and Canadian Dollar were important preliminary warnings of the violent reversals we are seeing this week. The 20 and 50-day exponential moving averages are reasonable price targets. As we have seen over the past decade the gold and silver markets are staging rallies with the decline in the US Dollar. Daily capitulations are also present in the crude oil and copper markets. Another point of interest in the oil market is the extent of the decline. The major declines of the past forty years found support and staged two to eight month consolidations/advances once prices had declined by roughly 56%. The only exception was in 1985 when Saudi Arabia increased production from 2 million bpd to 5 million bpd and that decline was 69%. That was part of the Reagan plan to defeat the Soviet Union. Something similar could restrict the ambitions of Putin and Chavez, for example.  As noted weekly capitulations were becoming evident in major indices with the financial panic into October 10th. The list now includes the S&P500, S&P 100, Dow Industrials, NASDAQ Composite, NASDAQ 100, TSX Mines & Minerals and CDNX Venture Exchange. The opinions in this report are solely those of the author. The information herein was obtained from various sources; however we do not guarantee its accuracy or completeness. This research report is prepared for general circulation and is circulated for general information only. It does not have regard to the specific investment objectives, financial situation and the particular needs of any specific person who may receive this report. Investors should seek financial advice regarding the appropriateness of investing in any securities or investment strategies discussed or recommended in this report and should understand that statements regarding future prospects may not be realized. Investors should note that income from such securities, if any, may fluctuate and that each security’s price or value may rise or fall. Accordingly, investors may receive back less than originally invested. Past performance is not necessarily a guide to future performance.Neither the information nor any opinion expressed constitutes an offer to buy or sell any securities or options or futures contracts. Foreign currency rates of exchange may adversely affect the value, price or income of any security or related investment mentioned in this report. In addition, investors in securities such as ADRs, whose values are influenced by the currency of the underlying security, effectively assume currency risk. Moreover, from time to time, members of the Institutional Advisors team may be long or short positions discussed in our publications. BOB HOYE, INSTITUTIONAL ADVISORS November 5th, 2008 EMAIL:: bobhoye@institutionaladvisors.com CHARTWORKS WEBSITE:: www.institutionaladvisors.com |

| Home :: Archives :: Contact |

SUNDAY EDITION May 11th, 2025 © 2025 321energy.com |

|