|

SUNDAY EDITION May 11th, 2025 |

|

Home :: Archives :: Contact |

|

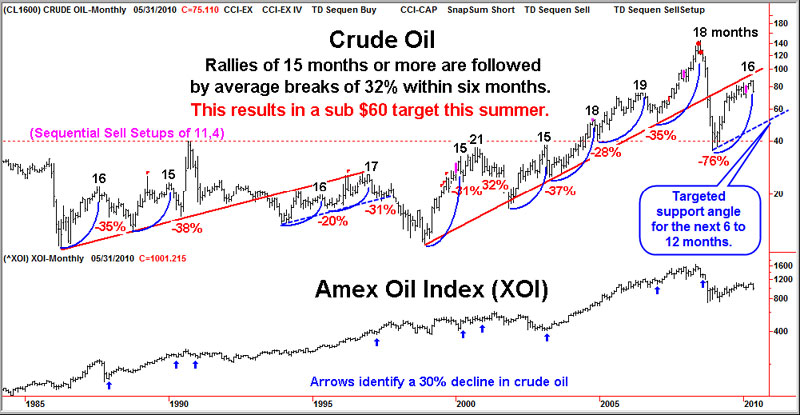

ChartWorksPUBLISHED BY INSTITUTIONAL ADVISORS May 14th, 2010 Technical observations of RossClark@shaw.ca Crude Oil – 16 Months of Strength Was Enough The April 16th analysis pointed out the sixteen months of strength in crude oil and the likelihood of it nearing a conclusion. The decline we experienced last week should be the beginning of pressure that could last for months. The following chart identifies numerous rallies of fifteen or more months and the subsequent downside breaks in price of 20% to 76% within six months. Excluding the 76% decline in 2008 the average drop was 32%. Monthly Sequential Sell Setups (modified to 11, 4), as occurred in February, have coincided or preceded half of the highs. A violation of April’s $81.29 low on May 5th became a confirmation of a sell signal. A 32% break provides a targeted low just below $60. The rising support line from $10.35 in 1998 through 2008 has been approached from the lower side during 2010. If the current decline is severe or lasts beyond six months then the parallel channel line from the December 2008 low should provide a targeted support in the low $50’s over the next year.

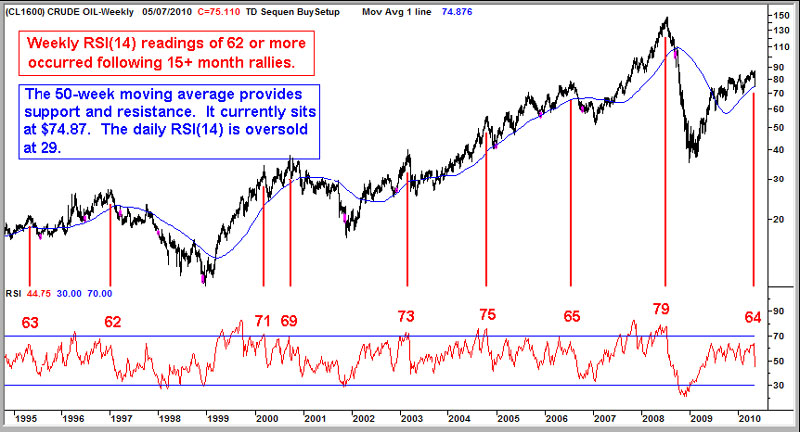

The weekly RSI(14) topped at 64 on April 30th. Levels of 62 to 65 or the 70’s have been the norm at 15+ month highs. A decline of 30% in crude oil would then present an opportunity to over-weight positions in oily stocks.

On the shorter-term, prices have declined to the 50-week moving average ($74.87) and the daily RSI(14) is oversold at 29. A bounce that retraces 40% of the decline from $87 would be normal. However, a break of the moving average that sees it rollover to the downside will turn it into a resistance level and warrant the deeper break over the coming months. BOB HOYE, INSTITUTIONAL ADVISORS May 14th, 2010 EMAIL:: bobhoye@institutionaladvisors.com CHARTWORKS WEBSITE:: www.institutionaladvisors.com The opinions in this report are solely those of the author. The information herein was obtained from various sources; however we do not guarantee its accuracy or completeness. This research report is prepared for general circulation and is circulated for general information only. It does not have regard to the specific investment objectives, financial situation and the particular needs of any specific person who may receive this report. Investors should seek financial advice regarding the appropriateness of investing in any securities or investment strategies discussed or recommended in this report and should understand that statements regarding future prospects may not be realized. Investors should note that income from such securities, if any, may fluctuate and that each security’s price or value may rise or fall. Accordingly, investors may receive back less than originally invested. Past performance is not necessarily a guide to future performance. Neither the information nor any opinion expressed constitutes an offer to buy or sell any securities or options or futures contracts. Foreign currency rates of exchange may adversely affect the value, price or income of any security or related investment mentioned in this report. In addition, investors in securities such as ADRs, whose values are influenced by the currency of the underlying security, effectively assume currency risk. Moreover, from time to time, members of the Institutional Advisors team may be long or short positions discussed in our publications. |

| Home :: Archives :: Contact |

SUNDAY EDITION May 11th, 2025 © 2025 321energy.com |

|