|

SUNDAY EDITION May 11th, 2025 |

|

Home :: Archives :: Contact |

|

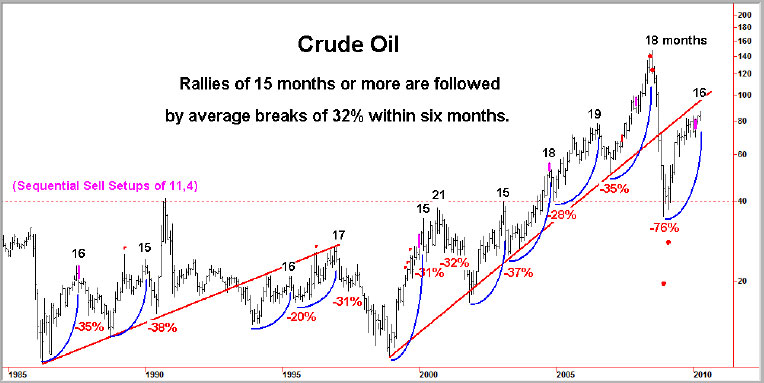

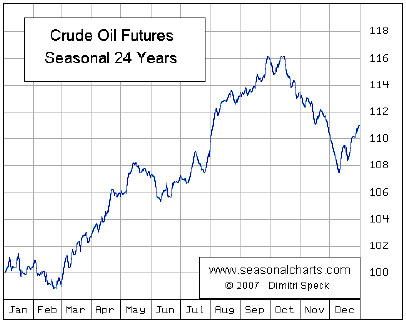

ChartWorksPUBLISHED BY INSTITUTIONAL ADVISORS April 25th, 2010 Technical observations of RossClark@shaw.ca Crude Oil – 16 Months of Strength Warrants Caution Crude oil has now rallied for sixteen months and is approaching a period of normal seasonal highs. The following chart identifies numerous rallies of similar duration and the subsequent downside breaks in price of 20% to 76% within six months. Excluding the 76% decline in 2008 the average drop was 32%. Monthly Sequential Sell Setups (modified to 11, 4), as occurred in February, have coincided or preceded half of the highs. A violation of a previous month’s low would become a confirmation of a sell signal. For now that is the March low of $78.06.

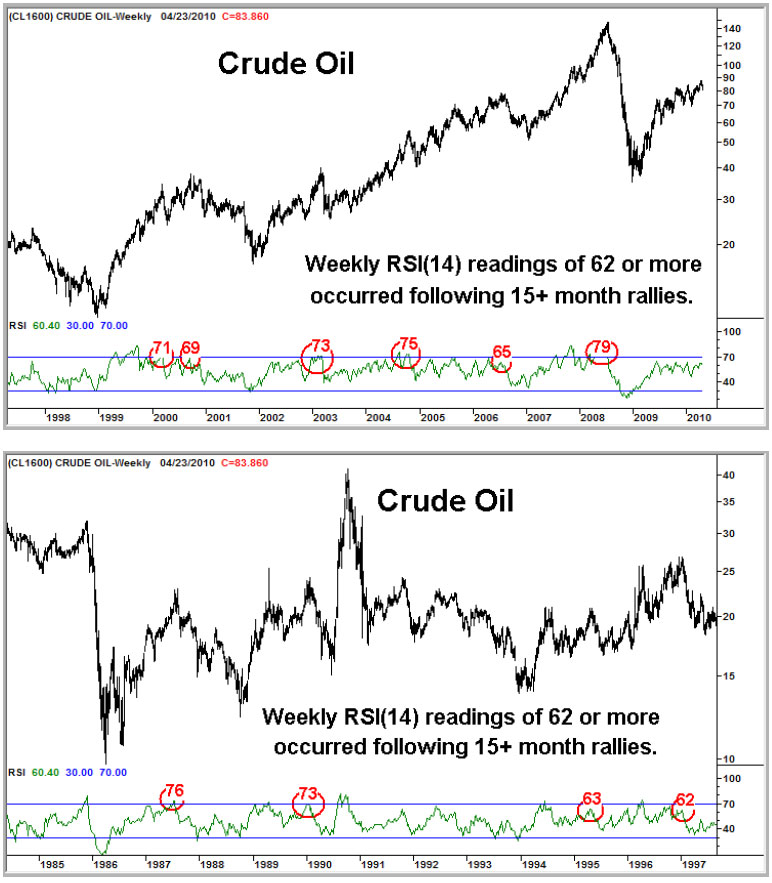

The weekly RSI(14) currently sits at 60, a little low for an important top. Levels of 62 to 65 or the 70’s have been the norm. Daily RSI readings around 70 are common at the tops, so be alert for any rally from the current level of 51 up to 70 as a reason to lighten up. If it coincides with a weekly reading in the 70’s then exit all long positions.

BOB HOYE, INSTITUTIONAL ADVISORS April 25th, 2010 EMAIL:: bobhoye@institutionaladvisors.com CHARTWORKS WEBSITE:: www.institutionaladvisors.com The opinions in this report are solely those of the author. The information herein was obtained from various sources; however we do not guarantee its accuracy or completeness. This research report is prepared for general circulation and is circulated for general information only. It does not have regard to the specific investment objectives, financial situation and the particular needs of any specific person who may receive this report. Investors should seek financial advice regarding the appropriateness of investing in any securities or investment strategies discussed or recommended in this report and should understand that statements regarding future prospects may not be realized. Investors should note that income from such securities, if any, may fluctuate and that each security’s price or value may rise or fall. Accordingly, investors may receive back less than originally invested. Past performance is not necessarily a guide to future performance. Neither the information nor any opinion expressed constitutes an offer to buy or sell any securities or options or futures contracts. Foreign currency rates of exchange may adversely affect the value, price or income of any security or related investment mentioned in this report. In addition, investors in securities such as ADRs, whose values are influenced by the currency of the underlying security, effectively assume currency risk. Moreover, from time to time, members of the Institutional Advisors team may be long or short positions discussed in our publications. |

| Home :: Archives :: Contact |

SUNDAY EDITION May 11th, 2025 © 2025 321energy.com |

|