|

SUNDAY EDITION May 11th, 2025 |

|

Home :: Archives :: Contact |

|

Economics and Nuclear Energy: A Long Modern SurveyProfessor Ferdinand E. Banksferdinand.banks@telia.com May 28th, 2009 Abstract: This survey extends a topic I briefly discussed during my recent course at the Asian Institute of Technology (AIT). Special attention is occasionally paid Sweden, because mainstream academic economics is focused on optimal arrangements, and this once described the Swedish nuclear sector, where the cost of nuclear-based power may still be the lowest in the world. Just as significant, for over a decade politically motivated efforts to eliminate nuclear as an energy mainstay have not been successful. Many observations below have appeared in my energy economics textbook (2007), however the structure of the present paper was motivated by the many valuable discussions on nuclear matters in the forum EnergyPulse (www.energypulse.net). A fundamental contention in this article is that a new energy economy must eventually be brought into existence, and this new economy would probably be sub-optimal without an expanded nuclear component (as well as many new renewables). Some mathematics appears in this exposition, but much of it can be ignored if it makes the reader uncomfortable.

Key Terms: Load Division, capital cost, nuclear fuel cycle, renewables

1. INTRODUCTION

As is well known, nuclear energy is not a popular medium with everybody. Even in France, virtually the capital of ‘the peaceful atom’, there are many persons who hope that someday another energy source will replace all or a large part of the almost 80 percent of the electricity supply that originates with nuclear. Frankly, even if there were a major accident in France, or a nearby country, that yearning seems unrealistic. In countries like France and Japan, where adequate energy is recognized as indispensable for maintaining economic competitiveness, the present energy configurations have never been seriously questioned. ‘No oil, no gas, no coal, no choice’ is the way the French put it, and although the energy prospects of many other countries may appear to be rosier, they could find themselves warbling the same melancholy tune some day. This does not mean however that it makes economic sense to consign conservation, renewables and/or other non-conventional (or alternative) energy sources and strategies to the margins of the energy scene. The ugly fact of the matter is that the world would probably be in a very bad way if these things do not become widely available in a few decades, or perhaps even sooner, because they might have to accommodate a very large part of the energy load in all except a few lucky countries. But one way to make sure that they will not be available is for a majority of the voters in a given country, or even a decisive sub-set of the voters, or for that matter just the decision-makers to accept the twisted hypothesis that it is economical to introduce these items on a large scale before present and future costs and other constraints are fully understood. When I say future costs I am thinking of how a rising price of e.g. oil and gas, as well as governmental policies concerning carbon emissions, will influence the present (opportunity) cost of nuclear. An example involving nuclear equipment might be useful here. The most widely used nuclear power generator today is the light-water reactor (LWR), so named as to distinguish it from the heavy water or deuterium oxide technology emphasized in Canada. (There is a short glossary in the appendix that is intended to clarify this terminology!) These reactors, their predecessors, and various ‘spin-offs’ are generally labelled first and second generation models. The most modern equipment available today however are the third generation models, such as the recently designated ‘Evolutionary Pressurised Reactor’, which was originally developed by France and called the European Pressurised Reactor (EPR). The intention with this reactor is to achieve an unconditional safety, in that ‘melt-downs’ cannot take place. (If control systems stop working, the reactor is supposed to shut down automatically, dissipate the heat produced by the reactions in its core, and prevent both fuel and radioactive waste from escaping.) One of these reactors – the largest in the world (at 1600 megawatts = 1600 MW) – is being constructed in Finland, and is designated Olkiluoto 3. Given the costly delays that have been experienced, and the high efficiency of existing Finnish reactors, a question could be asked as to whether, at the present time, it might have made more economic sense to construct two more LWRs (instead of Olkiluoto 3) if the same capacity was desired, taking special care to incorporate the latest technological attributes into these reactors. It is possible that a study of relative costs by Guentcheva and Vira (1984) of the Technical Research Centre (Helsinki, Finland) was important in convincing Finnish decision makers that there were substantial economic advantages of an increasing returns to scale nature to be gained by constructing a very large reactor. The equation they suggest as relevant in these matters and especially applicable to Finnish conditions is [(specific cost 1)/(specific cost 2) = (size 1)/size 2)m-1], where the values of m ranged from 0.38 to 0.75. On the basis of some empirical work by C.M. Held (1983) it appears that this equation is fairly useful, however its applicability to what is largely a new technological situation, where a number of things can go wrong for non-engineering reasons, is uncertain. At the same time it should be appreciated that had construction followed the conjectured plan, with ‘ground break’ taking place in 2005 and ‘grid power’ achieved in 2009, Olkiluoto 3 could be labelled a very profitable enterprise – except of course by members of the anti-nuclear booster club. The opinion here is that even with the unexpected increase in expense due to an increased construction time, in the long-run the Finns will be grateful for the presence of this equipment, and I have been informed that still another of these (Gen 3) reactors may be constructed.. It has also been claimed that a fourth generation reactor is not many years away. This kind of reactor will feature much higher temperatures, which in turn would raise the reactor efficiency by a large amount. It could therefore be suggested that faced with an increased rate of depletion of oil and natural gas, the energy strategy employed by Switzerland during World War Two – which featured a very high degree of electrification of the entire economy – should be given careful consideration by energy-intensive countries. It has been estimated by the German firm Siemens that there will be 400 new reactors in the world by 2030, although it is impossible at the present time to reckon their size and technological details. Siemens just announced that it will join the Russian firm Rosatom for the purpose of developing and selling Rosatom’s pressurized water reactor, particularly in Russia, China, India and Bulgaria. In 2008 construction began on two new reactors in Russia, which should be good news for Germany and several other countries, because it could increase the availability of natural gas for Russia’s gas customers. The early theorists of Soviet communism seemed to believe that Soviet power plus electricity would create a heaven on earth. Similarly, the implicit assumption in Sweden after the Social Democrats assumed power was that something called the ‘Swedish welfare state’ would emphasize social democracy plus electricity. A low level statistical analysis and a simple algebraic demonstration makes it clear that in terms of reliability and cost, the Swedish nuclear sector was the most efficient in the world before the curse of (electric) deregulation arrived. It is due to an intensified concern for the economic future that the irrational nuclear ‘downsizing’ in this country (Sweden) has been at least temporarily halted. The key departure was upgrading the ten remaining reactors so that they could produce the same electric energy (in kilowatt-hours = kWh) as the original twelve reactors, which amounts to nearly 47 percent of the total generated energy. (Approximately the same amount is accounted for by hydro.) The logic here is straightforward, and cannot be altered by the resolute ignoring or disparaging of mainstream economic history: a high electric intensity for firms, combined with a high rate of industrial investment and the technological skill created by a modern educational system, will lead to a high productivity for large and small businesses. This in turn results in a steady increase in employment, real incomes, and the most important ingredients of social security (such as pensions and comprehensive health care). This is exactly what happened, and a relevant question of late is whether a once magnificent welfare ‘structure’ that – for a number of years – was a roll model for the residents and politicians of many countries, can be kept afloat if some of the most modern electric generating facilities in the world are scrapped for short-term political considerations. For instance, in order to recruit supporters with anti-nuclear tendencies, the recent Social Democratic prime minister informed actual and potential voters who prefer opinion and feelings to evidence and logic that nuclear power was “obsolete”. As it happens, this judgement was the opposite of the truth. The Nobel laureate Dennis Gabor once called the nuclear reactor the most important scientific invention of the 20th Century, and its further development should make it one of the most important implements of the present century. In the light of human needs and desires, few energy sources have more to offer than the reliable and comparatively inexpensive electricity that might be made available when the next generation (or generations) of nuclear equipment comes into being. For some obscure reason, in l978 all the major political parties in Sweden agreed that the growing controversy over the future of nuclear energy should be settled by a national referendum. The electorate was subsequently asked to choose between nuclear acceptance, or the more-or-less immediate closing of as many nuclear facilities as possible, or a gradual phase-out that was to be complete by 2010. Confronted by a whirlwind of neurotic fictions launched by a technophobic nuclear opposition, the latter option was selected. Although not fully comprehended by most Swedes even now, a key factor in that pseudo-scientific travesty was an assumption that the rising prosperity of Sweden could be maintained even if the country’s nuclear assets were liquidated. In other words, the choice between nuclear energy and ‘something-else’ was reduced to a matter of taste, and to add insult to injury, the country’s energy assets were pictured by many politicians as having little or nothing to do with the macro-economy, although in point of truth they have everything to do with it. To a considerable extent, that ill-founded assumption is now passé, which is why a small majority of Swedish voters are no longer hostile to nuclear. In the UK, on the other hand, some polls indicate that many voters want to see nuclear and coal-based installations phased out in favour of renewables, while the UK government is in favour of a nuclear revival. This is because, as former Prime Minister Blair once observed while commenting on some environmental considerations, without such a departure it will be impossible to achieve large reductions in carbon dioxide (CO2) emissions. And not only Mr Blair. James Lovelock, a founder of Greenpeace, has surprisingly said that we do not need to fear nuclear energy, which he endorses as “the safest and most environmentally friendly source of that vital product, electricity.” No country has made as great an effort to include renewables in the energy mainstream as Sweden, but even so the result in terms of the energy now being generated is insignificant. Many Swedes now realize that while technically renewables can be substituted for nuclear, the benefit-cost ratio is economically unacceptable. The decision makers in the UK know this too, because much of their talk about environment derives from their concern about energy: if more nuclear is not provided, there will have to be a greatly increased resort to coal.

2. INTRODUCING CAPACITY FACTORS AND BASE LOADS:

Before going to some slightly more technical considerations, there is one aspect of the present debate about nuclear energy that everyone should consider. It turns on the expression Capacity Factor (CF), which has to do with the amount of energy that is actually produced over a given period as compared to the amount that could be produced if the facility had operated at maximum (or rated) output one-hundred percent of the time. This can be written CF = Actual Energy Output over a given period divided by Rated or Maximum Output. When you hear about the beauty of wind or solar energy, make sure that you ask about the Capacity Factor. Consider a wind turbine with a power rating of 100 kilowatts. In a month of 30 days its maximum energy output is 100 x 30 x 24 = 7,200 kilowatt-hours. However its measured output during that period would likely be lower, and perhaps much lower. Suppose it was 3,600 kilowatt hours. Then we would have CF = 3600/7200 = 0.50 = 50%. For wind a capacity factor of 15-35% appears average; and Jeffrey Michel confirms a stable 0.17 average for Germany before 2007, although it might have reached 0.2 in 2007. As for nuclear, 30 years ago capacity factors in the U.S. were about 55% due to the ‘down-time’ caused by unscheduled outages and scheduled maintenance, but now outages have decreased and average values are above 85%. Also, if capacity factors are calculated net of scheduled outages, then occasionally they are about 95%, which apparently applies to plants managed by e.g. Exelon. Now examine an important diagram.

Figure 1a is about the configuration of demand, with the story told on the basis of capacity. To be specific, the demand for electricity (or electric capacity) typically varies during a day (24 hours) in the cyclic pattern shown in Figure 1a. The load (on the vertical axis) is in kilowatts (kW), or megawatts (MW) or something of that nature (where ‘mega’ stands for millions). Here you can think in terms of the size and number of light bulbs in your residence, many of which are not on in the middle of the day, while all of them could be on in the evening. We might therefore say that your demand ‘peaks’ in the evening. On the horizontal axis in Figure 1a are hours, ranging from e.g. midnight to midnight – a 24 hour period. (Naturally we could have used a one month or one year period). Thus the ‘box’ that is designated “Base Load” is a portion of the energy that is expended during a 24 hour period, and this is measured in e.g. kilowatt hours (= kWh). The remainder of the energy for this period (in kWh) is the remainder of the area under this curve. Continuing with the light bulb example, you do not pay the firm that supplies you with electricity for the size of your light bulbs, but you pay them for the amount of electric energy you actually require and they provide, just as they pay the seller of e.g. coal or gas or ‘uranium’ for the items they use to produce electricity (and in which the energy resides in the first place). The base load here can be thought of as the load (in e.g. kW or MW) that is always on the line, while the peak load is the maximum load on the line, and which typically is in place for only a comparatively short period. A base load power plant is one that customarily provides a steady flow of power to a grid (i.e. a collection of power lines), and operates at all times except for unscheduled ‘down-time’ and scheduled maintenance. Clearly, few readers would deny that the base load ought to be ‘carried’ by extremely reliable equipment. They should also add the expressions base load and peak load to their vocabularies as soon as possible, especially if they would like to participate in influential discussions on the present topic as an equal rather than an interloper. In addition they should attempt to comprehend that we will not have much use for the highly stable demand curves featured in our courses in microeconomics. Figure 1b is one of this kind, and it unfortunately has a tendency to make appearances in important documents where it does not belong. Many readers probably understand that if generating equipment is extremely expensive – as is the case with a very large nuclear or coal power plant – it cannot be an optimal arrangement to allow it to stand idle during most of the day in order to be available during the period when there is a peak load to be serviced. Conventionally, nuclear, coal, hydro and – since the introduction of combined cycle equipment – gas have been important for the base load, while gas and to a certain extent hydro have been important for the peak load. I have also heard it claimed that small pebble-bed reactors may be constructed in the future that are capable of supplying economic peak-load power. In fact there is a claim that so-called mini-reactors employing this technology can be installed with no more effort or complexity than installing a large transformer. The beauty with this equipment is that it can be hermetically sealed and its power is available for 40 or 50 years. Some years ago, when I was in the U.S. Army, and for a short time stationed near Yokohama (Japan) in the vicinity of a small dam, I was able to get some insight into the functioning of a hydroelectric installation. One of the more interesting (informal) lectures I received on that occasion had to do with the unapparent flexibility of that facility, and just as interesting, the last time I visited Japan I was told that large dams are often capable of ‘returning’ well over than 50 times the energy invested in them – by which it is meant that if the money invested in constructing these dams were translated into energy units (which is a simple algebraic operation) and compared to the energy generated by these structures over their expected lifetimes, the ratio would be at least fifty. Only nuclear approaches this impressive result.

3. DEEPER MEANINGS

This section borrows from and extends some observations made in my short paper ‘SOME FRIENDLY ECONOMICS FOR THE NUCLEAR ENERGY BOOSTER CLUB’ (2008), which I took the liberty of circulating widely to many members of that club, as well as a number of ladies and gentlemen who were probably less than pleased to receive my humble opinions of nuclear energy or anything else. I also take this opportunity to provide a low-key discussion of several comments on that paper. But before doing that I would like to claim that perhaps the most straightforward reasoning in favour of nuclear-based electricity is in the non-technical article of Rhodes and Beller (2000). They say that “Because diversity and redundancy are important for safety and security, renewable energy sources ought to retain a place in the energy economy of the century to come.” The meaning here is clear, especially if you add that we probably will never possess what is known in intermediate economic theory as the optimal amount of nuclear power. Next they unambiguously state that “nuclear power should be central….Nuclear power is environmentally safe, practical and affordable. It is not the problem – it is one of the solutions.” Everyone of course does not welcome this kind of reminder. The construction of the Swedish nuclear sector and its later development was one of the most impressive engineering phenomena of the 20th century, however eventually a glib argument began to circulate that nuclear energy was just a “parenthesis” in world energy history, and a recent prime minister called nuclear “obsolete”. Just for the record, the Swedish nuclear sector – comprising 12 reactors, and supplying almost half of the Swedish electric power – was constructed in only 13 years. In the period, before electric deregulation gained momentum, the cost of electricity generated in Swedish nuclear facilities was among the lowest in the world – and occasionally the lowest. In addition, to my great surprise, I discovered that the Swedish electricity price was also extremely low. This was especially favourable for the Swedish industrial sector. In the most nuclear intensive country in the world – which is France – the intention from the beginning was to create a nuclear sector that would provide some of the lowest priced electricity in the world, and to use that electricity to make it possible for the country to optimize its macroeconomic performance. Unlike the situation in Sweden, the French decision makers made plans to stay in the forefront of nuclear development, and in addition to provide both the industrial and household sectors with reliable and comparatively inexpensive electricity. They also expressed a desire to achieve and maintain a low level of carbon emissions. Assuming that this is comprehensible, I would like to emphasize that nuclear cost issues need to be examined in greater detail for a meaningful discussion of electricity generation to take place. For France the basic comparison was between nuclear and coal, and given the various costs associated with importing and using coal, it was easy to show that nuclear was preferable. It might be possible to argue successfully that this is not true for the U.S., but I happen to skeptical. This issue cannot be treated at great length in the present paper, but my energy economics textbook (2007) presents a more detailed clarification. The core of my argument turns on the supply of reactor fuel, the length of ‘life’ of a reactor, the lack of carbon emissions, the possibility of a radical improvement in reactor technology and the time required to construct reactors (which is important for the investment cost, which in turn is important for the capital cost). Below I briefly consider this matter, while it is examined at considerable length in the mostly non-technical chapter on nuclear in my textbook. I can add that I always insist that my students should be able to distinguish between investment cost and capital cost. I have had the misfortune to see many estimates of the cost of a kilowatt of capacity of nuclear energy. Too many as far as I am concerned! They range from $1500/kW by the director of an electric generating firm, to $9000/kW by a gentleman who is convinced that most of my work on the economics of nuclear energy hardly deserves to be called nonsense. In my own calculations I often use $2500-3000/kW. In a similar vein, a (3rd Generation) reactor is being constructed in Finland at the present time that has a capacity of 1,600 megawatts (= 1600 MW), which makes it the largest in the world from the point of view of capacity, and initially the intention was to construct it in 5 years. An early estimate of its investment cost was 5 billion dollars. Now it appears that it will take 8 years to construct this reactor, and it has been claimed that before grid power is attained, its cost may reach 8 billion dollars, and perhaps slightly more. None of this bothers me, because although much of this depressing news originates with engineers who have a far more thorough knowledge of industrial management and engineering than I ever possessed, I am satisfied with my ability to examine the issue on the basis of economics and history. First of all we can consider the time from construction start to commercial operation of nuclear power plants in six important industrial countries. The figures that will be given below originate in the database of the International Atomic Energy Agency, and are quoted in an important article by Roques, Nuttall, Newbery, de Neufville and Connors (2006). I have also questioned Fabien Roques – who wrote the chapter on nuclear energy in the latest IEA survey – and he assures me that he finds them realistic. I quote them here employing the scheme [Country (Minimum Time, Maximum Time, Average Time)], where the times are of course construction times, and these are measured in years. China (4.5, 6.3, 5.1); France (4.9, 16.3, 7.1); Japan (3.3, 8,1, 4.7); Russia (2.1, 20.3, 6.8); UK (4.9, 23.5, 10.8); U.S. (3.4, 23.4, 9.2). In examining these it should be clear that the average times are weighted in terms of capacity (i.e. power) or energy. Worldwide, since l991, the figures given by Roques (et al) are (4.0, 8.0, 5.2). With an average construction time of 5.2 years, it might therefore be possible to argue that taking 8 or 9 years to construct a nuclear facility is an aberration, and in the fullness of time, the average plant will be constructed in about 5 years. My position of course is that once the nuclear renaissance get up steam, the average plant will be constructed in 4 years or less. As I informed someone in one of the forums to which I contribute, unlike most concerned citizens, I know what happened in e.g. the United States during the Second World War. The battle of Midway took place in l942, and in the approximately 3 years following that major naval clash until the end of the war, the United States constructed 17 fleet (i.e. large) aircraft carriers, 10 medium carriers, and 86 escort carriers. In addition crews and pilots were trained to efficiently and successful utilize these assets, and hundreds of other warships were produced. It should be appreciated that before the U.S. entered the war, nobody in their right mind would have claimed that the ‘miracles’ of modern technology and management skill that became commonplace during the war were possible. Another quantitative triumph was the U.S. armoured force, although techologically I regard it as deficient. The main U.S. battle tank, the Sherman, was produced in the thousands, even after it was discovered that it was an inferior piece of equipment. What is still not adequately understood is that it would have been extremely simple to produce in large numbers the qualitatively superior Pershing tank. Had that been done, and the approaches to the port of Antwerp cleared when they should have been cleared, American armor would have been across the Rhine and in Berlin before Christmas of 1944. I call this a gigantic failure to exploit existing technology, and the same kind of flaw applies to the inability to greatly reduce the time of construction of nuclear plants. According to Donald E. Carr in his brilliant book (1976), the Japanese were able to construct a nuclear plant in 4 years in the l970s, which leads me to believe that they will be able to construct one in 3 years when their decision makers and voters eventually comprehend what awaits their standard of living if they do not get the energy message. (I was also told some years ago in Vienna that the Japanese government is in no hurry to increase the size of the present nuclear inventory. What they want instead is to introduce breeder reactors, which would enable a greater utilization of the energy in a reactor’s fuel.) It might also be possible to argue that if at the present time if it takes 5 years or more to construct a nuclear plant, then coal is a more economic resource for electric generation than nuclear, but since I expect nuclear plants to eventually take less than 4 years to construct, this should not be the case. I can close this part of the exposition by pointing out that when the next (or 4th) generation of nuclear plant appears, it probably won’t make a great deal difference if it does take 5 or 6 years to construct a nuclear facility: in theory, 4th Generation equipment is greatly superior to previous models. I would also like to stress that I am familiar with many of the claims of nuclear failure that are in constant circulation throughout this old world of ours, but as it happens I am singularly unimpressed. American industry was able to bring about miracles during WW2 because for the most part pessimism and failure were not encouraged – as is NOT the case today with both nuclear energy and the U.S. macroeconomy. At the same time I am willing to admit that while many beliefs about the energy future that are often found in the U.S. and Sweden do not make any economic sense at all to me, I am convinced that if the citizens of those two countries continue to accept that more money is preferable to less money, then a different attitude toward nuclear energy will eventually appear. As David Schlageter pointed out in EnergyPulse (2008), “Renewable energy sources only supplement the electric grid with intermittent power that rarely matches the daily electrical demand.” He continues by saying that “In order for an electric system to remain stable, it needs large generators running 24/7 to create voltage stability. Wind and solar generation are not on-line when needed to meet energy demand, and therefore to help decrease system losses.” In the promised land of wind energy, Denmark, voltage stability is attained by drawing on the energy resources of Sweden and Germany (and perhaps Norway). The Danes pay for the imported electricity, but not for the stability – which they would do in the great world of neo-classical economic theory. It can be suggested though that the Danes may be unable to afford more than basics where electricity is concerned. According to NUS Consulting (of South Africa), the price of electricity in Denmark was the highest in the world in 2006 and the next highest in 2005. It can hardly be lower today. In 2005 Sweden had the next lowest price, and in 2006 the fourth lowest. Something must be drastically wrong in the Kingdom of Sweden for voters and politicians to remain passive in the face of this deterioration, particularly when NUS statistics indicate that the rise in the Swedish price is one of the most rapid in the world, and is almost certainly due to three things: a preposterous electric deregulation, membership in the European Union, and the closing of two nuclear reactors. The thing that should never be forgotten here is that for geographical and industrial reasons, Sweden is one of the most energy intensive countries in the world. As a result, a high energy consumption should be considered a necessity rather than a luxury. Before changing the subject, some information about the capacity factors of wind installations that was presented on EnergyPulse by Len Gould (2008) and Kenneth Kok (2008) can be cited. Unfortunately I cannot say whether these are extreme or typical cases, but they have one thing in common that all readers of this and other papers on energy economics should remember: the actual output from wind installations is often not just lower than the rated (or ‘nameplate’) output, but very much lower. Gould cites an operation by an independent North American wind power company in which the actual capacity factor for 2007 was somewhere between 8.67% and 17.35%. This might be characterized as a revolution in energy technology in reverse. Even so, it was superior to a performance noted by Kok, in which a TVA facility on Buffalo Mountain (near Oliver Springs, Tennessee) registered a capacity factor considerably under the above figures. In these circumstances it should be easy to understand why it was impossible to convince the voters and decision makers in Finland that in order to obtain the increase in electric energy that might be necessary for that country to maintain its standard of living, nuclear installations – with perhaps the highest capacity factors in the (base load) world – were preferable to windmills. For those readers who have been exposed to secondary school algebra, the above reference to things like voltage stability is superfluous. Over the last decade Sweden and Norway may have produced, on the average, the lowest cost electricity in the world. Norway, however, generates almost all its electricity with hydro, which is generally recognized as the lowest-cost power source, while Swedish electricity is produced in almost equal amounts by hydro and nuclear. On the basis of some elementary algebra presented later in this paper, it can be argued that the unit cost of Swedish nuclear power is equal to the unit cost of Norwegian (and Swedish) hydro. Strangely enough, this is an outcome that has not been welcomed by many observers in Sweden and Denmark, for whom the illusion of inexpensive and plentiful renewable energy is more real today than ever. Moreover this illusion is constantly reinforced by persons with a certain access to the media, but with only a minimum background in energy economics. But what about nuclear waste, which is repeatedly portrayed as a malicious and unavoidable cost of nuclear based electricity because, ostensibly, it will have to be locked up for hundreds of thousands of years? It is sometimes maintained however that the cost of disposing of nuclear waste is balanced by the benefit of no carbon-dioxide (CO2) emissions from reactors. For instance, the International Energy Agency (IEA) has calculated that for France – the country with the largest production of nuclear energy (as a per cent of the total output of electric power) – the average person is responsible for 6.3 tonnes of carbon dioxide (per year), which e.g. is one-third of the U.S. average. The cost-benefit trade-off mentioned above is worth remembering, however I prefer for students to know (and be able to explain) why France intends to treat ‘waste’ as a potential fuel. (A similar strategy has been proposed by the UK’s energy minister.) A law now exists in France stipulating that toxic waste is to be stored in such a way that it can be comparatively easily accessed and recycled if, at some point in the future, “new” technologies appear which will allow it to be classified a preferable input in the nuclear fuel cycle. The latter provision is, as the reader might guess, partially intended to appease or possibly bewilder nuclear sceptics, because technology is already available for recycling this ‘déchet’, and in the event that the price of newly mined and processed uranium escalates, it would almost certainly be utilized without further debate. A long exposition of how a recycling program might take place is found in a conference paper by Kenneth Kok (2007), and in a paper written with Ricardo Lopez (2008), Professor John Scire of the University of Nevada (Reno) proposes recycling as a substitute for storing the annual output of U.S. waste. Moreover, as pointed out by James Hopf (2008), nuclear plants in the U.S. are charged a fee of 0.1 cents/kWh to pay for the nuclear waste program, and just as important it is unlikely that this cost would ever exceed 0.25 cents. This is a comparatively small amount of money, which leads Hopf to suggest that where the management of “waste streams” is concerned, nuclear is a superior technology. The same conclusion is reached by Rhodes and Beller (2000)n, and here it needs to be emphasized that nuclear technology is in its infancy. The plant being constructed in Finland at Olkiluoto is a so called ‘third generation plant’, where the emphasis seems to be on eliminating the likelihood of a ‘meltdown’, but the real prize might turn out to be a ‘fourth generation’ installation, which operates at radically higher temperatures that permit a more thorough exploitation of its fuel. It has been suggested that this kind of facility will be especially important if the supply of uranium is reduced, however as noted by many comments published in EnergyPulse and elsewhere, few persons who work with or near uranium believe that there will be a shortage of this commodity in the foreseeable future, even if the forthcoming nuclear revival eventually assumed the dimensions of a Manhattan Project. It can also be mentioned en passant that there is at least as much fissionable thorium available in the crust of the earth as uranium, and Norway may well be a source of some of the largest deposits. Consequently, the bad consciences that some Norwegians seem to display because of the wealth of their country, will probably be shared by at least several future generations. In the case of Sweden, the low cost of nuclear and hydro power, and fairly smart regulation, made it possible to provide electricity to the industrial sector at a comparatively low price – at least until electric deregulation gained momentum. This being the case, nothing is more offbeat than hearing about the “subsidies” paid the nuclear sector. Cheap electricity meant the establishment of new enterprises, and just as important the expansion of existing firms. The tax revenue that was directly and indirectly generated by these activities, and used for things like health care and education, more than compensated taxpayers (in the aggregate) for any ‘subsidies’ that might have been dispensed by the government. An antithetical situation may prevail for wind and biofuels. In Germany the energy law guarantees operators of windmills and producers of solar energy an above-market price for power for as long as 20 years. This is an explicit subsidy, although it may be both economically and politically optimal due to the reduction in greenhouse gas emissions. More important, some inexpensive electricity for plug-in hybrids is made available. An especially complex subsidy apparently accompanies the exploitation of biofuels. Research taking place in the United States, and reported in the influential journal Science, claims that almost all biofuels used today result in more greenhouse gas emissions than conventional fuels if the pollution that is both directly and indirectly caused by producing these ‘green’ fuels is considered. In addition, there would be a substantial loss of ‘consumer surplus’ throughout the world due to a likely increase in food costs. Some of the intricacies of this important issue have been examined on an elementary level by Clay Ogg (2008). Against this background it might be argued that France’s total acceptance of nuclear power makes a great deal of sense, and its details deserve more attention. As noted in the Financial Times (October 6, 2006), nuclear power has provided “an abundance of cheaply-produced electricity, made the country a leader in nuclear technology worldwide and reduced its vulnerability to the fluctuations of the turbulent oil and gas markets.” France can also supply some electricity to neighbouring countries, which helps counterbalance the short sighted foolishness being promoted by the European Union’s Energy Directorate. (See also the survey by Murray Duffin (2004) and the comments on that survey.)

4. A MINIMAL OUTLINE OF THE NUCLEAR FUEL CYCLE “Satisfaction…came in a chain reaction.”

In my courses on energy economics and international finance, I have made a point of informing students that there are certain things that I expect them to learn perfectly if they prefer a passing to a failing grade, and the same will apply to the items in this section the next time I teach energy economics. The reason is simple, and is based on the likely appearance of considerable new nuclear capacity (especially in Russia, the U.S., India, China and Japan) that deserves to be studied and understood by persons who may find themselves in position to influence the configuration of the energy structure in their country or their local community, or for that matter merely to comprehend and explain some aspects of nuclear energy to friends and neighbours. There will also be new capacity in localities where politicians and their foot soldiers have repeatedly taken what amounts to a sacred vow to never think about or build or tolerate the construction of another reactor, because once TV audiences fully grasp what the lack of abundant energy will mean for them personally, an accelerated reassessment of the nuclear option will likely take place. It is often said that the world’s first ‘nuclear reactor’ – which in reality was an experimental device of a very primitive sort whose function was to obtain the first man-made sustained nuclear reaction – was constructed by Enrico Fermi. This took place in the squash courts under the stands of the football stadium at the University of Chicago. That charming stadium had been removed from the great world of (American) football because the University’s president regarded the sport as inconsistent with the intellectual grandeur he desired for the institution over which he had unfortunately been granted authority. The first peacetime nuclear plant was used to power the U.S. submarine Nautilus – although some observers preferred the label ‘wartime extension’ to ‘peacetime’. This was in January 1954. Six months later the Russians constructed a small nuclear-based installation whose purpose was to supply power to non-military users, and in October 1956 the first full-scale nuclear plant for civilian use was opened at Calder Hall in the UK. The first genuine ‘civilian’ power plant in the U.S. began operation in l958 at Shippingport, Pennsylvania. Perhaps the most interesting event during that phase of the Cold War however was the launching of the submarine USS Sea Wolf in l956, which evidently contained a liquid-sodium cooled breeder (or breeder-like) reactor of the type that Ralph Nader once referred to as “maniacal”. The ‘breeder’ will not be given much attention below, but it can be emphasized that its performance differs greatly from the light-water reactors (LWR) that form the major part of the U.S. nuclear inventory. Light-water reactors tend to feature two models: the boiling water reactor (BWR) and the pressurized water reactor (PWR). We can now turn to the simple physics of nuclear energy. Energy produced from fossil fuel is the result of an uncomplicated chemical process, however energy produced from nuclear fuel originates in the force binding the constituent parts of the fuel’s atoms together, and its release features the alteration of the structure of the atom itself. This is probably one of the reasons why the Nobel laureate Professor Dennis Gabor called the nuclear reactor the most important scientific achievement of all time. There may be some question as to whether it deserves that spectacular designation, but in many respects it is the most sophisticated. Two terms probably already found in the vocabularies of readers of this exposition are molecules and atoms, but they should be reminded that the latter is essential when examining the present topic. The expression molecule was coined by René Descartes in the 1620s, by which he meant an extremely minute particle: for the most part molecules cannot be seen with the naked eye, although apparently there are exceptions. Molecules are made up of at least two kinds of atoms in a definite arrangement, held together by strong chemical bonds. For instance, the water molecule is composed of hydrogen and oxygen atoms, and designated H2O. Atoms are generally thought of as ‘indivisible’, or the smallest particles characterizing a chemical element, but in reality sub-atomic particles have been identified. Almost all of an atom’s mass is found in its nucleus, which contains neutrons and (positively charged) protons, surrounded by swarms of (negatively charged) electrons, and the larger this nucleus, the easier it is to obtain the desired release of energy. Uranium is so important because one of the heaviest (and most complicated) atoms in nature is the isotope 235 of uranium, which is the only naturally occurring nuclear ‘fuel’ that will support a chain reaction. Its conventional designation is U-235, and it is important to know that different isotopes of an element occupy the same position in the periodic table, but they do not have the same weight. U-235 contains 235 ‘particles’, with 92 protons and 143 neutrons. The other isotope of uranium is U-238, with 92 protons and 146 neutrons. (The difference in weight is attributable to the neutron difference.) Fission is the breaking apart of a nucleus following the absorption of a neutron. If U-235 absorbs one additional neutron, it can become unstable and divide into two or more ‘fragments’ (sometimes called “atomic nuclei”), in addition to several neutrons. The mass of these fragments and neutrons is now somewhat less than that of the original nucleus and, most importantly, the reduction in mass corresponds to an increase in kinetic energy (i.e. motion), which is converted into heat as the fission products collide with surrounding atoms. Other U-235 atoms may absorb the neutrons released by a previous fission and themselves undergo fission. A release of neutrons that leads to further fission constitutes a “chain reaction”. What we have here is a mass-to-energy conversion of the kind associated with Albert Einstein’s famous equation E = mc2, where m is mass, c is the speed of light in a vacuum and E is energy. This equation specifies that the amount of energy that can potentially be released by only a small mass is huge. A complication however is that once a chain reaction develops, some sort of control is necessary to ensure that it continues at a steady level: sufficient but not an excess of neutrons must be obtained, and they must move at the right speed. On average this means that one neutron should lead to only one more fission. What is not desired is an uncontrolled exponential growth of fissions, which in the worst of cases could result in a meltdown, i.e. an overheating of the reactor core, or even an explosion. (It can also be noted that the neutron – discovered in l932 by James Chadwick – is the key to nuclear fission, because as a result of being neutral, it is not repelled by ‘Coulomb’ forces associated with atoms.) Occasionally we hear the expression critical mass in the discussion of this process. (This is also used in socio-dynamics, where it means the existence of sufficient momentum in a system so that the momentum becomes self-sustaining and fuels further growth. ‘Bandwagon effect’ was an expression that was popular when I studied economics, and it had to do with a kind of (social) critical mass.) It is important to appreciate that U-235 is fissile, but not U-238, however it is equally crucial to recognize that U-238 is fertile, which means that it can be the source of fissionable material not found in nature if it is bombarded with neutrons in a reactor. That material is plutonium (Pu, or Pu-239). Another fertile element is thorium, which was mentioned above, and reportedly is as abundant in nature as uranium. It can also be made fissile via neutron bombardment in a conventional reactor. Natural uranium consists of 99.3 percent U-238 and only 0.7 percent U-235, and any variant of uranium ore or processed uranium with the same isotopic composition found in nature carries the delineation ‘natural’. (There is a slight approximation here because there is a minute quantity (or ‘trace element’) of U-234 in natural uranium that is always ignored when discussing fission.) The relatively small amount of U-235 introduces a complication into obtaining a chain reaction, because enough enrichment must usually take place to raise the amount of U-235 in reactor fuel to at least 3%. At the same time it should be understood that there are reactors – such as the Canadian CANDU reactor – where unenriched natural uranium is an input. What characterizes this equipment is a thorough removal of non-uranium impurities, which together with the employment of suitably designed neutron reflectors and a heavy-water moderator can provide a chain reaction. Although enrichment is a very costly activity, there does not seem to be any hard evidence that (economically) CANDU type reactors are superior to light water equipment, apart from CANDU managers not having to worry about an unexpected spike in the cost of enrichment, which is a discomfort that LWR managers might suffer if enrichment takes place externally. The term ‘moderator’ used above has to do with reducing the speed of neutrons, so that the main source of energy is the break-up of heavy fissionable atoms that are struck by relatively slow rather than fast neutrons. Often the moderator is water or gas, but in the CANDU it is heavy water, which means water containing deuterium atoms. By way of contrast, the breeder is often called the ‘fast breeder’ because neutrons are not slowed down, and in the breeding process, neutrons from the splitting of Pu-239 convert non-fissile U-238 to additional Pu-239. According to Barre and Bauquis (2007), a unit of fuel in a breeder can provide almost 100 times more energy than it would in e.g. a LWR. Now for a brief resumé of the nuclear fuel cycle. The front end begins with mining. This activity is not as straightforward as it sounds, because the ore that is mined usually contains well under 1% uranium. In its pure form uranium is a silver-gray metallic chemical element that is approximately 70 percent more dense than lead (and weakly radioactive), and this metal can be obtained by crushing and grinding the ore. However, since there is relatively little demand for the metal, uranium is usually sold in the form of ‘yellowcake’, which is still classified as natural uranium. In A.D. Owen’s seminal book on the economics of uranium (1985), he states that one tonne (= 2204 pounds) of uranium metal (U) corresponds to 1.18 tonnes of yellowcake (U3O8). To obtain yellowcake, further processing in the form of milling and leaching (with sulphuric acid) must take place. In summation, the product of a uranium mine-mill complex is yellowcake, which on average is 70-90% uranium oxide (U3O8), and yellowcake is sold on a U3O8 content basis. The quoted price of ‘uranium’ that is presented in the trade literature is actually the price of yellowcake, which in turn is the price per pound of U3O8. Yellowcake is the basic raw material for fission fuel, and once obtained is converted into uranium hexafluoride (UF6), which is heated into a gas that is suitable for enrichment. As noted above, the purpose of enrichment is to increase the percentage of fissionable U-235 in a bundle of natural uranium from approximately 0.7 percent to about 3 percent, or perhaps slightly higher. The higher the degree of enrichment, the easier it is to maintain a chain reaction, and so the volume of the reactor can be reduced. (There has been a great deal of talk recently about certain countries taking enrichment to a point where they can obtain weapons-grade uranium, which means enrichment to about 93% U-235.) Uranium enrichment services are sold in Separative Work Units (SWUs), which is a measure of the amount of ‘effort’ needed to separate U-235 from U-238. A useful term in this process is depleted uranium (DU), or ‘tails’ , which is the byproduct of enrichment. It is the uranium remaining after removal of the enriched fraction. The tails also contains some U-235, but much less than that found in natural uranium. The remaining proportion is described in terms of a tails assay, and according to Owen (1985) is typically between 0.2 and 0.3 (as compared to 0.7 in natural uranium). The lower the tails assay, the more energy (in SWUs) required to produce a given amount of enriched uranium. It also turns out that producing a ton of enriched uranium requires about 6 tons of natural uranium, with the remaining 5 tons called depleted uranium (or tails). All enrichment is a very complicated (i.e. expensive) process, however its technology has been greatly advanced by moving from gaseous diffusion to the centrifuge system, and further improvements are almost certainly possible. Once UF6 is obtained, a further conversion into uranium dioxide (UO2) takes place, and this is fabricated into pellets. The pellets are loaded into specially designed tubes. In a light water reactor the rods are inserted into the reactor where fission takes place, and the ensuing heat raises steam in a boiler which turns a turbine-generator that produces electricity. From the boiler to the back end of the cycle a nuclear power plant is the same as a plant operating on coal or gas, with approximately the same thermodynamic characteristics. The thing to appreciate here is that a reactor is primarily a source of heat, and this heat is converted into mechanical energy by a turbine, and electricity via a generator. Much of this heat is lost, although clearly it could be a valuable input to households, industries and various commercial establishments. When a reactor has been in use for a certain period, the percentage of U-235 in it has decreased, and because of this and the contamination of the fuel elements by fission products, the efficiency of the chain reaction is reduced, and eventually it cannot be sustained. Spent fuel is then removed from the reactor and ‘fresh’ fuel inserted. The spent fuel is mostly (but not entirely) U-238 , and it cannot be used in ‘slow’ reactors, but if put in e.g. breeder reactors and exposed to high energy electrons, it can be converted to fissionable isotopes of plutonium. (This expression ‘tailings’ is also sometimes used with respect to spent fuel). A peculiarity with the cycle discussed above is that, theoretically, it is incomplete. The spent fuel that is taken from the reactor is usually stored, however instead it could be reprocessed and in one form or another fed back into the reactor, thereby completing the cycle. If this is not done, what we have is a once-through cycle, where the spent fuel is put into temporary storage, and kept there until consigned to permanent storage – preferably underground. Put another way however, this spent fuel is not ‘waste’ – which it is often called – but potential reactor fuel, because it contains an impressive amount of fissionable materials. Were it not for various political and environmental constraints, a larger amount of it would be turned into plutonium (which could be directly used in a breeder reactor) or a plutonium-laced mixture called MOX (mixed-oxide fuel) for reinsertion into modified conventional reactors. Perhaps the main bugaboo is that reprocessing involves the handling or availability of a relatively large amount of plutonium, which is a substance whose presence in large quantities is not to be recommended if our political masters deal with this commodity the same way that they often treat other potential menaces. By way of winding up this part of the exposition it should be noted that two terms that often appear when the conversation turns to reactors are thermal reactors and fast reactors. Both require a fissionable fuel, which for a fast reactor can mean Pu-239 as well as U-235, and both require a coolant to counteract the heat that is created as a result of fission. Thermal reactors also require a moderator to slow down neutrons, as well as various components to ensure that the fission is controllable. The fast reactor also requires a mechanism for control, but it is very different from that employed in a thermal reactor. These are a few other rather special items that could be taken note of, especially if the fast reactor is also a breeder (i.e. creates more fuel than it uses), but these cannot be discussed in an overview of this nature.

5. SOME BASIC ANALYTICS

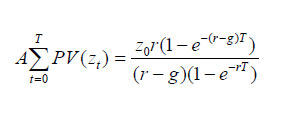

Readers of this paper should now be in possession of sufficient terminology to convince fellow party animals that they have something useful to offer when the discussion turns from jazz or Frank Sinatra to nuclear energy; and for persons who feel at ease with the topic, the present section should enhance their knowledge of the subject. Particular attention should be paid to equation (2) below, even if the algebra before and after this relationship causes a problem. The items that will be taken up below are the capital cost of nuclear, followed by an output-input analysis that concludes with the so-called ‘burn-up’ (which has to do with the efficiency of using uranium), and finally, I want to discuss with a few equations a contention I have made in many lectures and informal conversations about the comparatively low cost of nuclear electricity. To be exact, since Sweden and Norway may still produce the lowest cost electricity in the world – although Norway employs almost exclusively hydro, and Sweden nuclear and hydro – some algebra shows that Swedish nuclear has about the same low cost as Norwegian and Swedish hydro. Although the lowest cost electricity does not mean that buyers of this good will always enjoy the lowest price, it is surprising (to me) to observe that over the past decade, the price of electricity in Sweden was among the lowest in the world. That price is rising now, largely because of Swedish entrance into the European Union. On the other hand, at the present time, Denmark has the highest electricity price in the industrial world, which can only be explained by its over-utilization of wind power. Next we can turn to a useful pedagogical first step for working our way toward a key economic concept. This involves a two year situation in which $1000 is borrowed and used to invest in an asset, for example, a mini-reactor that will be placed in the basement of your house, and which will be amortized in two payments over (an amortization period of) two years. The rate of interest (or the discount rate) in this example will be taken as 10% (or 0.10). (Amortization means repaying a debt, which in this example is tied to the purchase and cost of a reactor.) It is here that we introduce the term annuity, which is the amount (A) paid at the end of every period (e.g. year), and as will be calculated below, the annual amount ‘A’ is equal to $576. This means that in repaying the debt (=$1000), we pay $576 at the end of the first year, and also $576 at the end of the second year. The debt ‘today’ is $1000, and if paid at the end of two years, the lender would receive F = PV(1+r)T = 1000(1+0.1)2 =1210 dollars if 10% is the rate of interest. Let’s put this as follows: F in T years is equivalent to PV today. Also, please note that the $1000 is not the capital cost: it is the investment cost. We can take a closer look at this theme. There is a payment of $576 at the end of the first year, and this is equivalent to 576(1+0.1) = $633 at the end of the second year. If we add this to the annuity payment of $576 at the end of the second year, it sums to approximately $1210, or the same as above. It can thus be specified that, ceteris paribus, paying $1000 now for the asset, or paying $1210 at the end of two years, or paying $576 at the end of the first and second years are (in theory) equivalent, given that 10% is the applicable rate of interest.. Note the ceteris paribus criterion, because obviously in real life there are situations where this ‘equivalence’ would not be accepted, particularly by a lender. Something else that can be mentioned is that if the reactor had been paid for in cash removed from your wallet or purse at the time it was purchased, rather than borrowing to make the purchase, the concept of an annuity would still be valid. In this case the annuity payments represent the opportunity cost of purchasing this asset instead of e.g. lending the cash today and earning interest (amounting to e.g. $210 after two years). Now let’s generalize this two period example to T periods. Two equivalent arrangements for paying a debt of PV (called the present value) that is entered into at the beginning of the first period is to pay PV(1+r)T (= F) at the end of T periods, or via annuities ‘A’ at the end of each period (e.g. year), beginning with the end of the first period, and ending at the end of the last period! Thus we can write: PV (1+r)T = A + A(1+r) + A(1+r)2 +……..+ A(1+r)T-1 (1) This is a key expression, and if the reader has any problems here, he or she should work with the two period example given above. Next, multiplying both sides of this expression by (1+r) we obtain: (1+r)[PV(1+r)T] = A(1+r) + ………+ A(1+r)T We continue by subtracting the second of these expressions from the first: [(1+r)T] PV[1 – (1+r)] = A – A(1+r)T From this we obtain equation (2) below, which turns out to be:  If we make PV = 1000, r = 0.10 and T = 2, then we can calculate A = 576, as noted above. ‘A’ is generally referred to as ‘levelized cost’ in most of the technical literature relating to nuclear energy: it is the periodic payments for a reactor costing PV. This important expression could also be derived using elementary calculus, beginning with a fundamental (neo-classical) economics concept: the capital cost of an investment can be defined as the uniform return per period that an asset must earn, in order to achieve a net present value of zero. In other words, the asset price is the present value of future net yields (i.e. revenues minus costs). We can proceed by considering the output-input analysis of electricity production with a nuclear reactor, beginning with the observation that based on its atomic structure, 1 gram of pure U-235, completely fissioned, can produce 0.9 MWd (= 0.9 million watt-days = 0.9 megawatt days) of energy, and so the amount of U-235 necessary to produce 1 MWd of energy is 1.1 grams, assuming again that the fuel is completely fissioned in a perfect reactor – i.e. a reactor without heat loss. (An example is in order here. Suppose that you have an ideal reactor in your basement that is fuelled with 1.1 grams of pure U-235, and ten 100 watt bulbs (= 1000 watts) are burning all day every day in your humble abode. Then, if you could burn that uranium in some sort of ideal reactor-furnace, your house can shine brightly for 1000 (= 1,000,000/1000) days, where the units here are watt-days/watts = days. Note, 1 gram = 0.0022 pounds, which is a number that might be useful later on, as is 1 tonne = 2204 pounds.) But heat loss is a thermodynamic fact of life, and so to get 1 MWd(e) of electric energy we might need e.g. 3 MWd (thermal), where thermal relates to the fuel being used, which in this case is uranium. Accordingly, with one giga-watt (e) = 1 GE(e) = 1000 MW(e) operating over a year on the output side, our U-235 requirement on the input side is 3000 x 0.85 x 365 x 1.1 = 1,023,825 grams, where the assumption for this example is that the capacity factor – the fraction of a year that the reactor is actually operating – is 85%. Joseph Somsel though (2008) suggests that 90% is a more appropriate value. Note again the difference between MWd (energy) and MW (power), and MWd(e) and MWd(thermal). However heat loss is not the only bad news here, because the fuel that is inserted into a reactor is not pure U-235, as was indicated earlier in this paper. Instead it is a bundle of U-235 and U-238 that has been enriched from 0.7% of the former to at least 3%. As noted earlier, an item on the positive side is that some of the U-238 was converted by electron absorption to Pu-239 and fissioned, but this process is slower than the fissioning of U-235. It thus turns out that to complete our work we require a technological parameter that will tell us about the efficiency of utilization of the (enriched) uranium fuel – i.e. fuel containing both U-235 and U-238 – and this is called the burn-up. The burn-up is the total amount of heat energy created per unit of uranium fuel (i.e. enriched uranium)! In economics this would be called an input-output coefficient. A figure that I saw recently is 33,000 MWd per tonne (which corresponds to 33,000 x 1.1 grams (of U-235) per tonne of (enriched) uranium fuel), but the belief is that it can go higher. Put simply, the burn-up is the heat energy produced per unit of fuel weight. Using the previous calculation we get for the annual use of uranium by the reactor in order to generate 1000 MWd(e) the quotient [3000 x 0.85 x 365 / 33,000] = 28.2 tonnes of enriched uranium. (The input-output character of this calculation is best seen by forgetting about the uranium equivalencies that came into the picture with the use of the number 1.1, and simply noting that the MWd(thermal) input in order to obtain 1000 MWd(e) for a period of one year is 3000 x 0.85 x 365 MWd divided by 33000 MWd per tonne, and once again the answer (= 28.2) has for units tonnes (where l tonne = 1t = 2204 pounds). Remember that this 28.2 tonnes is enriched uranium, and so it might be possible to propose another input-output relationship between enriched and natural uranium. Using some numbers in the book of Professor Anthony Owen (1985) I calculated that 26 tonnes of enriched uranium corresponds to about 150 tonnes of natural uranium, and so the input-output coefficient is six. Thus, 28.2 tonnes of enriched uranium calls for 162 tonnes (t) of natural uranium. Next we use equation (2) to calculate the capital cost and the capital cost component of the energy cost for an interest rate of 5%, an investment cost (PV) of $2500 per kilowatt of capacity, and two values of T: 30 years and 60 years. ($2500 per kW of capacity is/was the investment cost for the US and EU used by the (French) General Directorate for Energy and Raw Materials, or (DGEMP), but once reactor construction achieves a faster pace, $1500/kW might be possible.) With T = 30 years, the levelized cost of a kilowatt of capacity is $162.5 dollars per year for 30 years, as calculated from equation (2). If we are interested in the energy cost (associated with that number) , and the capacity factor is e.g. 0.85, then we begin by noting that the amount of base load energy produced in a year by one kilowatt is 24 x 365 x 0.85 = 7446 kWh. The capital cost component of the energy cost is thus 162.5/7446 = $0.022/kWh = 2.2 cents/kWh. Now take T = 60. The levelized capacity (or capital) cost becomes $131.25/kW, while as a component of energy costs this is 131.25/7446 = $0.017/kWh. (The other components of the energy cost – the fuel cost and operations and maintenance (or O&M) cost – will be taken up in Section 6). Clearly, as T increases, the capital cost decreases. I chose 30 years to begin with because that is the value often seen when discussing the ‘life’ of nuclear facilities, but it happens that reactors are being constructed with an expected life of at least 60 or 70 years, and the lives of older reactors are being extended by upgrading. As for the interest rate used above, if the world functioned the way that I believe it should function, then the government would serve as a guarantor for amortization payments, and 5% would be a suitable interest rate to use in calculations of the type discussed above. As noted, the change in the capital cost that resulted from increasing T from 30 to 60 was comparatively small, however specialists in this topic are more concerned with the situation after T, when the capital cost is amortized, and buyers of electricity have access to electricity whose cost is only due to the cost of fuel and O&M. The same of course is true for electricity generated using gas and coal, however relatively speaking a large increase in the price of gas and coal has a much greater effect on the price of electricity than a corresponding increase in the price of uranium (i.e. yellowcake). With regard to the above calculation, I have absolutely no influence over the interest rate at which money can be borrowed by firms producing nuclear-based electricity, and so 5% is probably too low to use as a discount factor in the calculations made above. This matter will be taken up again Section 6 below, and another calculation will be made using more realistic figures. I can mention however that the numbers obtained later for the capital component of the energy cost are fairly close to those obtained by the French Commissariat de Plan, and reproduced by Barre and Bauquis (2007). The last exercise in this section involves a statement about the relative cost of nuclear, where relative means that it will be compared to hydro – which is the most inexpensive generator of electricity. Moreover, according to easily available data, the (average production) cost of electricity in Sweden, which involves hydro (H) and nuclear (N) is about the same as the average cost of hydro generated electricity in Norway. (The price to consumers may or may not be the same, which is irrelevant for the present discussion). Calling Sweden country 1, and Norway country 2, the following algebra seems appropriate, where C/q (Cost/quantity) represents average cost:

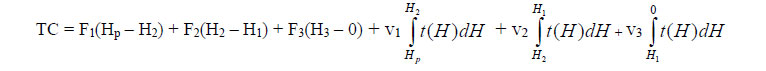

This can be written in the following manner, where q is the total output of electricity in Sweden: Both sides of this expression can now be multiplied by q, and in addition q1N can be taken as ?q and q1H as (1 – ?)q. Using these in the above expression we are then able to write the above expression as  The q’s can be cancelled, and making the reasonable assumption that C1H/q1H = C2H/q2H, some simple manipulations will give us:  What this says is that the average cost of nuclear generated electricity in Sweden is equal to the average cost of hydro generated electricity in Norway, which in turn is probably the lowest cost electricity in the world. The price of uranium (fuel) is a topic that requires an extensive discussion, but while that discussion is comparatively simple, it will have to be provided elsewhere. It can be mentioned though that even if the price of yellowcake greatly increases, students of this topic have expressed no alarm. They know that if (or when) uranium (and thorium) become scarce, there will be more reprocessing of spent fuel, and in addition – for better or worse – the breeder reactor will have its opportunity. Some of us however are not enthusiastic about the latter option. 6. SOME ECONOMICS OF LOAD DIVISION

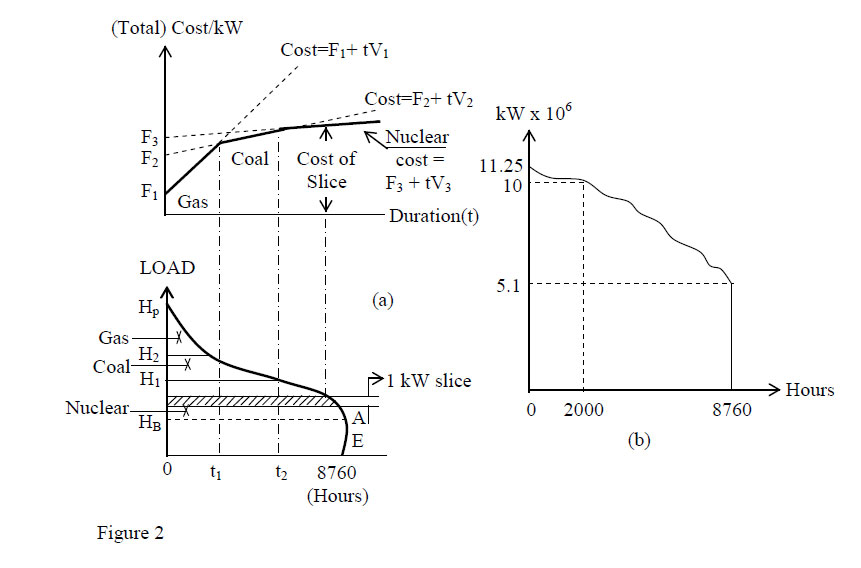

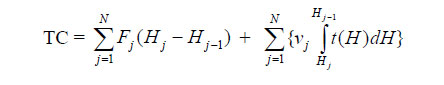

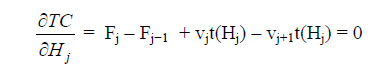

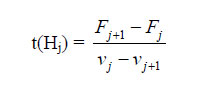

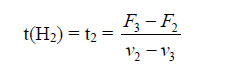

We can begin this section by specifying three kinds of equipment that can produce electricity. These are gas-based, with a low capital cost (F1), but a high variable cost (v1); coal, with a capital cost (F2) that is higher than gas, but a variable cost (v2) that is lower; and finally nuclear with the highest capital cost (F3), but the lowest variable cost (v3). This arrangement can be seen in the top diagram of Figure 2a. Once again the cost relationships are linear and of the type C = F + vt, with the applicable part of these curves being the solid lines that form the aggregate cost curve, The discussion usually involves a capacity of 1 kW, but these screening (i.e. cost) curves are applicable for any capacity.  In turning to Figure 2, we can begin with 2b, which shows the load on the line in Norway in 1975. The maximum load was 11.25 x 106 kW, while during 2000 hours of the year the load varied between 11.25 x 106 and10 x 106 kW. Between 2000 hours and one year (= 8760 hours), the load was between 11.25 x 106 and 5.1 x 106 kW. As can be noticed, never during the year did it fall below 5.1 x 106 kW, and so it is clearly appropriate to designate 5.1 x 106 kW as the base load, although it could happen that the base load equipment supplies some of the intermediate load. What about the intermediate and peak load? This is more or less subjective, however I am sure that Norwegian engineers were capable of making the optimal choice, whatever it turned out to be. The exposition will continue by extending the examples given in the previous section. The first step is to put the load diagram at the bottom of Figure 2a into perspective with the screening (i.e. cost) curves at the top of Figure 2a. As in the previous section we can write as the values of the costs C1 = F1 + v1t, C2 = F2 + v2t and C3 = F3 + v3t. Something that can be noted again is the expression merit order, where the intention is to determine which type of equipment carries which load, and over what portion of the year (of 8760 hours). What we are going to find out with some simple algebra is that in the arrangement in the figure, gas generates the peak load, coal generates a part of the intermediate load, and nuclear generates the remainder, which in this diagram means the base load plus a part of the intermediate load. Accordingly, during a part of the time nuclear is idle, and so it might be designated a reserve, since after all there is considerable uncertainty associated with the ex-ante (i.e. before-the-fact or predicted) load. It might be argued that this is a bad example, since it is a waste to have expensive nuclear equipment idle, however given the cost curves, the specification of cost-minimization leaves us with no choice. (It seems that a reserve of 15-20% is usually deemed correct, although at the present time in the U.S. and perhaps other countries it has been suggested that there has been serious underinvestment in power sources and especially transmission lines.) Using the algebra and elementary logic from the previous section, it is a simple matter to find t1 and t2 in the above diagram. To get t1 we start with F1 + v1t = F2 + v2t. This immediately gives us F2 – F1 = t (v1 – v2), and so t = t1 = (F2 – F1)/(v1 – v2)). Obtaining t2 is just as easy, but it will be left for you to do as an exercise. Notice also that from the point of view of signs, the value of t1 makes sense, because F2 > F1 and v1 > v2, and thus the quotient is positive. Let’s also notice that in this example if we say that we have a peak, intermediate, and base load, only the base load 0-HB is unambiguous. The peak load definitely appears to be H2-HP and the intermediate load HB-H2, but aside from the algebra there is a certain ambiguity about these two which is not important for the readers of this book – nor for its author. We can imagine a number of hypothetical situations which would have a place in this discussion. For instance, one might be that after we make our calculations, gas carries none of the load. Why? The only possible answer is that it costs too much relative to coal and nuclear. On the other hand, it may carry the entire load. Why? The short answer is that it is less expensive than the other options. Consider the situation in California over the past decade. As a result of technology improving combined cycle gas-based equipment until it became very efficient, and the gas price remaining very low until the last few years, gas based equipment became sufficiently economical to generate a much larger share of the electric load in that state than previously contemplated. The same thing happened in the UK with the so called ‘dash for gas’. As bad luck would have it though, the gas price suddenly escalated, and while existing gas-based equipment could not be instantaneously discarded, when new generating equipment was considered, gas looked much less attractive. Accordingly there is a difference between the optimal merit order and the existing merit order. Readers who have come this far without feeling frustrated can feel very satisfied, because in truth I am always amazed by the shortage of knowledge about nuclear economics. It’s interesting to note that in Australia, plants that are designated intermediate load plants comprise about 40-45 percent of total installed capacity, as compared to 50 percent for base load plants, and 5-10 percent for peaking plants. This says something about the place of uncertainty in these matters and how it causes a deviation from the ‘ideal’ or optimal merit order of the type being presented above where we get unambiguous answers as to the value of t1 and t2. Generally the peak load represents only a small fraction of the demand for electricity, and it can happen that only a portion of this capacity is in use, but since the available generating equipment must be able to satisfy the maximum demand that may appear in the system, capacity or load factors for peak load facilities are often quite small. As a result, if possible, as much peak load power as possible should be purchased rather than generated in the system, and as a result many utilities do everything possible to satisfy these requirements by purchases from other cities, states, regions or countries. The expression load factors was used above. This can be defined as the Average Load divided by the Peak Load. Ideally this is fairly large (i.e. close to unity), but there can be some ugly surprises where electric generation is concerned, and so in some regions considerable excess or reserve capacity must be available because there can be a simultaneous peak in neighbouring regions. In some classroom discussions students want a formalization of the results presented above on ‘load division’. Here I can point to an important article by Michael Einhorn (1983) whose mathematics I have altered somewhat to correspond to my classroom presentations of this topic. The following expression should be self-evident if the reader comprehends Figure2, and is familiar with integral calculus.  Integrations take place horizontally, and involve slices of the capacity H bounded by the vertical axis and the systems load curve. This is synonymous to equation (4):  Next we differentiate TC with respect to, for example Hj, and set the resulting expression equal to zero. This gives us (5):  From this we obtain for a cross-over time:  For instance:  We have an overtone of (Albert) Einstein’s equivalence theorem here in that two approaches (informal and formal) lead us to the same result, which suggests that the same fundamental law is operating, and the informal presentation was also about cost minimization.

7. MORE BACKGROUND FOR CURIOUS READERS