|

WEDNESDAY EDITION December 24th, 2025 |

|

Home :: Archives :: Contact |

|

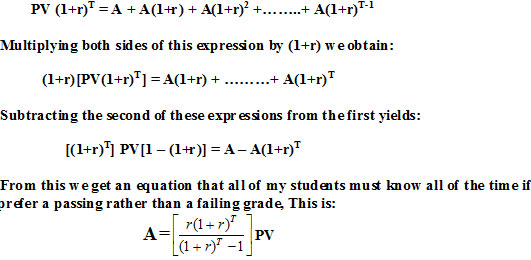

A Keynote Address on the Nuclear RevivalProfessor Ferdinand E. Banksferdinand.banks@telia.com January 15th, 2011 This is the keynote address I plan to give at the 2011 international conference of the International Association of Energy Economists (IAEE), which will take place this year in wonderful Stockholm in June. This assumes of course that I will be invited to present a keynote address, or even invited to give any sort of address, or for that matter will be allowed in the building where these noble scientific proceedings are taking place. I do not think that I will lose any sleep over a possible exclusion however, because a large part of this paper was published in Concordiam, which is a journal sponsored by the George C. Marshall European Center of Security Studies, and therefore means that if there is any pique because of my making it available to a wider audience, and I return to the United States in the near future, I could receive the opportunity to discuss it at a seminar in the Guantanamo Detainment Center, about which I heard exciting things from two members of my platoon who had been stationed there several years earlier. One thing however is very different in this paper from the previous version. Some very bad mistakes have been and are being made about the cost of nuclear energy. In my forthcoming energy economics textbook (2011), I argue that 'cost-wise', in the medium to long run, for base load power, nuclear is the optimal electricity source. It is also perhaps the most reliable (because of the availability of nuclear fuel), and very likely the most flexible. Since I would like for this paper to be read, understood, thought about and perhaps discussed in elegant seminar rooms, I will not burden readers with a long-winded discussions of these issues, although acquaintance with one concept is essential, and I attempt to introduce it in a brief mathematical appendix. THE BASIC ARGUMENT In a talk that I gave in an important workshop at the University of Siena (2009), I took the liberty of explaining why a peaking of the world oil supply was certain, and conceivably sooner rather than later. At the same time I explained that when the price of oil could touch one hundred and forty-seven dollars a barrel (= $147/b) in 2008, and bona-fide experts claim that a price in excess of $100/b is possible in the coming months, it seems appropriate to suggest that a flattening of the global oil output curve is scarcely worth noticing. The question now becomes what does this have to do with nuclear energy, and the short answer is everything: when the price of oil escalates, references to nuclear energy multiply in many publications and on many television screens in every corner of the industrial world. This is perfectly natural, because oil is a benchmark for the world energy economy, a standard of value, and a large increase in price is a notice that bad economic news might be on the way. The dilemma is that an exhaustible resource (i.e. oil) whose exhaustibility becomes increasingly apparent with every passing year, has a tendency to lose its charm. Eventually it brings frowns to the faces, and questions to the lips, of rational human beings, which is a category that includes a few decision makers. That being the case, then instead of passively waiting for another large oil price increase to cut the ground out from under the international macro-economy, it might be wise to think in terms of constructing a more satisfactory energy system. Fortunately, a mention of that project can already be found in many newspapers and news magazines. It goes under the name of diversity. As it happens, diversity is a controversial concept, because it can mean radically different things to different individuals. In a brilliant and easily read article, Richard Rhodes and Denis Beller (2000) say the following: "Because diversity and redundancy are important for safety and security, renewable energy sources ought to retain a place in the energy economy of the century to come". By itself, this statement is enough to warm the heart of every environmentalist between Stockholm and the Capetown Navy Yard, and I hope that I am warmly appreciated for making it available. But they continue by insisting that "…nuclear power should be central. Nuclear power is environmentally safe, practical and affordable. It is not the problem - it is one of the solutions." One of the solutions! I wonder what Mr Axelsson, the director of the Swedish Environment Protection Bureau (Naturvårdverket) would say about that, if he consents to grace our humble conference with his presence, or the physics PhD Tomas Kåberger, chief of the Swedish Energy Directorate (Energimyndigheten). Axelsson published an article in a Stockholm morning paper which included some mathematics that would have been graded unsatisfactory in a first-year class at Boston Public. That gentleman was attempting to show the economic advantages of liquidating the Swedish nuclear sector and replacing it with wind turbines, although he must know that the cost of electricity, which in Sweden is determined by nuclear and hydro, is among the absolute lowest in the world, while the cost (and price) of power in Denmark - perhaps the promised land of wind energy - is among the highest in the world. He must also know that while Swedish scientists and engineers might sing the praises of wind and solar in public, in private they have the same opinion of them as I do: a limited amount of these items are justified, but only as appendages to nuclear (and hydro) based electric power. Moreover, since the capacity factor for wind in Sweden is at most 25 percent, an expensive backup for wind will generally be necessary. As a result, any calculation that shows wind as having a cost advantage over nuclear would hardly be considered valid after a closer scrutiny. Of course, a closer scrutiny is generally out of the question, because this energy 'truth' is just as unwelcome in Sweden as in most other countries. As for Dr. Kåberger, he is without a clue as to the dismal economic consequences that would result from eliminating nuclear from the future energy portfolio of his country. For many persons who deal with energy matters on a regular basis, the physics tends to be simple, but the economics is almost a complete mystery, and has been a mystery during the last 30 or 40 years - thanks to the absence of dedicated teachers and students of energy economics. I do not just mean Messrs Axelsson and Kåberger, and their splendid colleagues, but also those persons who decide how much we must pay for our electricity in the coming years, and to a certain extent where and how we live, what we drive or do not drive, and the employment prospects for our descendents. SOME EXAMPLES For many years I have made the following claim: many people who genuinely understand nuclear economics refuse to tell us about it, often for social or financial reasons, while others are unceasingly provided with golden opportunities to present their half-baked offerings in every seminar room and television station south of the Arctic Ocean. The flood of misinformation about energy matters has almost reached avalanche proportions, and can be expected to increase as the expression 'nuclear revival' (or nuclear renaissance) gains momentum. I discovered this when I taught at the Asian Institute of Technology (or AIT, in Bangkok, Thailand), where I also discovered that an illogical and inaccurate appraisal of the nuclear revival was being circulated in the vicinity of the university where I taught in Singapore many years ago. I am not generous enough to believe that the energy economists of the (UK) Financial Times know as much as I do, although they definitely know a great deal. However even so they apparently approved the publication of a long harangue by a certain gentleman in which he stated that we are inexorably moving toward a non-nuclear world in which all carbon dioxide (CO2) emissions are 'sequestered'. Jeffrey Michel, an MIT graduate who lives in Germany, and is a genuine expert on the engineering economics of coal, is no great friend of nuclear, but he has called the sequestering of CO2 a "thermodynamic travesty", and indicates that if it is taken to extremes, it could place a severe economic burden on countries where it is practiced. Another point needs to be made here. Five years ago the (UK) Royal Academy of Engineering presented some 'carbon net' values for electric generation sources that took into consideration the intermittency of wind (as reflected in the low 'capacity factors' of wind installations). The difference between the cost of e.g. nuclear and wind was so large in favour of nuclear, that I avoided controversy by not citing it in my work. But then I noticed that when the oil price began to move up, the same happened with the price of coal and natural gas. Many utilities in the U.S. were forced to introduce some of the largest rate increases in decades for electricity prices, and when asked why they immediately put the blame on the increase in cost of coal and natural gas, which clearly was correlated with the price of oil. At the same time, the nuclear-intensive firms Exelon (of Chicago) and the Constellation Energy Group were able to greatly increase their profits, because although they charged the same price for their electricity as non-nuclear competitors, the cost of uranium only increased by a small amount, if at all. Let me also suggest that if it had not been for the macroeconomic meltdown that began in July, 2008, the already high electricity costs to large industries in the eastern part of the U.S. might have increased by at least 25 percent. Germany also plays a provocative role in the global energy drama. The German prime minister and many in her government want an expansion of nuclear energy in Germany, while perhaps more than 50 percent of the voters in that country want it banished. What is not adequately understood is that if a complete nuclear retreat takes place, and the illogical ambitions of the European Union's energy directorate are realized, energy prices in Germany could go into orbit. Germany seems to have high hopes where renewables and increased gas imports from Russia are concerned, but the latter alternative might not be optimal in the long run. Instead, I prefer to believe that when possible countries like Germany should attempt to have their energy requirements accounted for by sources over which they have complete control (which does not mean that I question -nor am interested - in the intentions of Russia). At the same time I admit that on the basis of what I have heard in countries like Sweden and Germany, nuclear antagonists seem to possess only an adversarial interest in the energy future unless the discussion is about 'carbon free' items. Something that is missed here, and often by nuclear supporters, is that a highly efficient nuclear sector could turn out to be invaluable as a source of finance for investments in the renewables sector. This should be quite clear on the basis of advertisements by energy companies that are seen everywhere. Unfortunately though the expression 'social profit' would have to be used in a scientific explanation of this issue, and I doubt whether there are many up-market dinner tables where that concept is considered a welcome guest. A FINAL COMMENT In a long and complex article in the Energy Journal (2006), 5 important energy researchers present an argument for nuclear power as a hedge against uncertain fossil fuel and carbon prices, which is a departure that makes a lot of sense to me. The article also contains some helpful information about the cost of nuclear power during the years 2005-2006, or perhaps slightly before. Some unexpected increases may have taken place since that time, where I am thinking in particular of ex-ante and ex-post costs associated with the European Pressurized Reactor (EPR) that is being constructed in Finland, and which in terms of capacity (= 1600 megawatts) is the largest reactor in the world. The trouble in Finland is really quite simple. It is a 'one-of-a-kind' - or 'custom built' - reactor. In a decade or so reactors of that size, and larger, will almost certainly be standardized, largely put together (assembled) in factories, and should cost much less. Furthermore, it should be carefully noted that the Finns are already committed to purchase two more EPR reactors, although theoretically they are in an ideal position with respect to the natural gas of Russia and Norway. Something of particular interest to me was a statement at the end of that article: "The Finnish experience shows that if well-informed electricity-intensive end users with long time horizons are willing to sign long-term contracts, then nuclear new build can be a realistic option in liberalized markets". I have had a few words with Professor Newbery and others on this matter, and explained to those ladies and gentlemen in scholarly language that "liberalized" markets are irrelevant and 'goofy' in this context. Twelve Swedish reactors were rapidly constructed in a completely non-liberalized setting, and they helped give Sweden the lowest electricity costs in the world, and the highest income per head in Europe. Moreover, I assure you that there was never a question of this "build" being a "realistic option". It began shortly after the first oil price shock, and given the outlook it was the only option! Deregulation was insane! What I did not make clear to Professor Newbery was that the expression 'overnight cost' used in his article was not understood by any economist with whom I have talked anywhere about anything, and I wonder if the good Newbery really understood it himself, since about the time that article was written, he was riding high on the electric deregulation gravy train - a 'conveyance' whose beautiful excursion is essentially over as a result of skyrocketing electric prices virtually everywhere. In any event, he should make an effort to comprehend the following. Instead of 'overnight', I told my students in Bangkok to use 'over-the-counter'. Let's put it this way, a buyer goes into a local seven-eleven or some other convenience store and buys a nuclear reactor, which may or may not be assembled, and for which he or she pays a certain price measured in dollars per kilowatt. Assembled or not assembled, the reactor must be delivered somewhere and put in place, attached to the grid, etc. Accordingly, the over-the-counter price can be transformed to a (discounted) 'final' price, which is the amount paid (up-front) for a reactor ready to deliver 'grid power'. Now we can go to the Finnish reactor mentioned above, and also the reactors that apparently will be constructed in the United Arab Emirates by a South Korean firm. In both cases the 'all-inclusive' (up-front) price was reportedly 5 billion dollars, (and the construction/installation time initially mentioned in both cases was 5 years.) In Finland the final cost might come to 8 billion (mostly resulting from the construction/installation time being 8 years). As I was informed recently, the firm in charge of delivery/installation - Areva, of France - will have to "eat" the extra 3 billion. In the UAE things are expected to go more smoothly. However I do not know the exact details, nor am I really interested in them for my keynote lecture. The director of Areva though, Madame Lauvergeon, recently mentioned that Chinese firms may have the ability to put a 1000 megawatt reactor in place in well under 5 years (and it would have a 'life' of 60 years). According to my imprecise estimates, the 'present value' of the final cost should then be well under 5 billion dollars, which means that the 'workshop of the world' may have found still another niche which, in addition to flaunting a new look for other firms in the nuclear business, can help the Chinese government to realize its goal of directing the most competitive economy in the world. APPENDIX If you are burning with a desire to extend the above, an indispensable equation is the annuity formula. A simple derivation begins by noting that to pay a debt of PV (= present value) entered into at the beginning of the first period, is to pay PV(1+r)T at the end of T periods, or via annuities A at the end of each period, beginning with the end of the first period, and ending at the end of the last period! Thus we get:

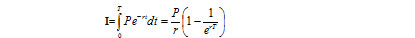

As compared to e.g. Abraham and Thomas (1970), use PV instead of P0, which might be designated the price of an asset. As an exercise here you can take PV as the cost of your private jet or your condo in Monaco or the South Bronx, and calculate the annual payments - or for that matter the monthly payments during T periods. This expression can also be derived using some elementary calculus, beginning with a fundamental (neo-classical) economic concept: the capital cost of an investment is the uniform return per period that an asset must earn, in order to achieve a net present value of zero. In other words, the asset price is the present value of future net yields (i.e. revenues minus costs). Notation in this derivation is changed somewhat in order to correspond to standard usage. Taking I as the asset price (i.e. the investment cost), P the capital cost per period, and r the market discount rate, we write for T periods:

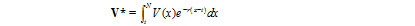

It takes a little manipulation to obtain P = rerTI/(erT - 1), and remembering that we can approximate erT by (1+r)T for small values of r, we get equation (A1), though with a different notation. The discount rate here was the market interest rate, which assumes no risk/uncertainty on the part of lenders and borrowers. This is not the kind of recommendation to be taken seriously outside a seminar room. An exercise I often gave my finance students began with the following:

There is just a 'play' on limits here, but with some different notation to confuse or test the unwary. Assume that a reactor lasts N years, and that its (net) earnings are constant. You then get the value at time 't', which can be discounted to give the value at time t=0. In Uppsala though the 'reactor' was a ski lift near the university. REFERENCES Abraham, C. and A. Thomas (1970). Microeconomie: Decisions Optimales dans L'entreprise et dans la Nation. Dordrecht (Holland); D. Riedel Publishing. Banks, Ferdinand E. (2011). Energy and Economic Theory. London and Singapore: World Scientific. _____.(2009). 'Some Energy Myths for the 21th Century'. Conference paper, University of Siena (Italy). _____.(2007). The Political Economy of World Energy: An Introductory Textbook. Singapore and New York: World Scientific' _____. (2001) 'A disobliging introduction to electric deregulation'. Conference paper, Hong Kong Energy Research Institute. _____. (1996) 'The future of nuclear energy in Sweden: an introductory economic analysis'. Energy Sources. Rhodes, Richard and Denis Beller (2000), 'The need for nuclear power'. Foreign Affairs (January-February). Roques, Fabien and William J Nuttall, David Newbery, Richard de Neufville, Stephen Connors, (2006), 'Nuclear power: a hedge against undertain gas and carbon Prices. The Energy Journal (No. 4).

Professor Ferdinand E. Banks January 15th, 2011 ferdinand.banks@telia.com

|

| Home :: Archives :: Contact |

WEDNESDAY EDITION December 24th, 2025 © 2025 321energy.com |

|