|

FRIDAY EDITION March 14th, 2025 |

|

Home :: Archives :: Contact |

|

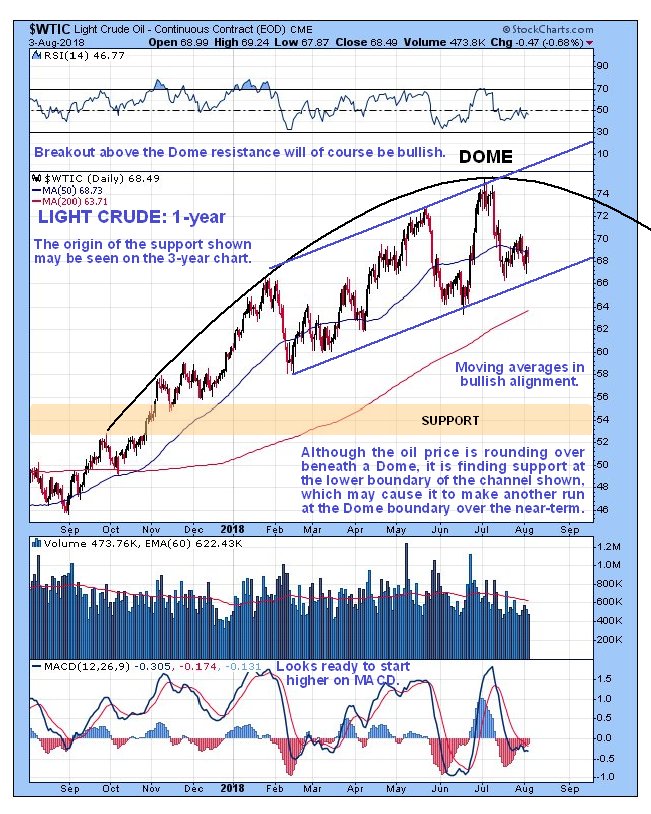

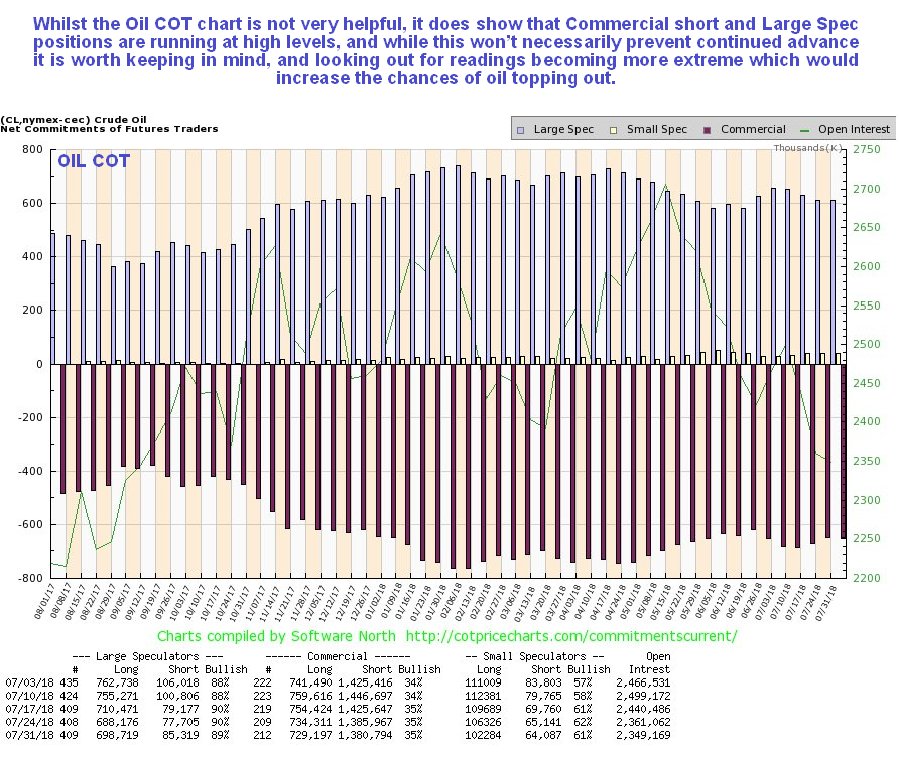

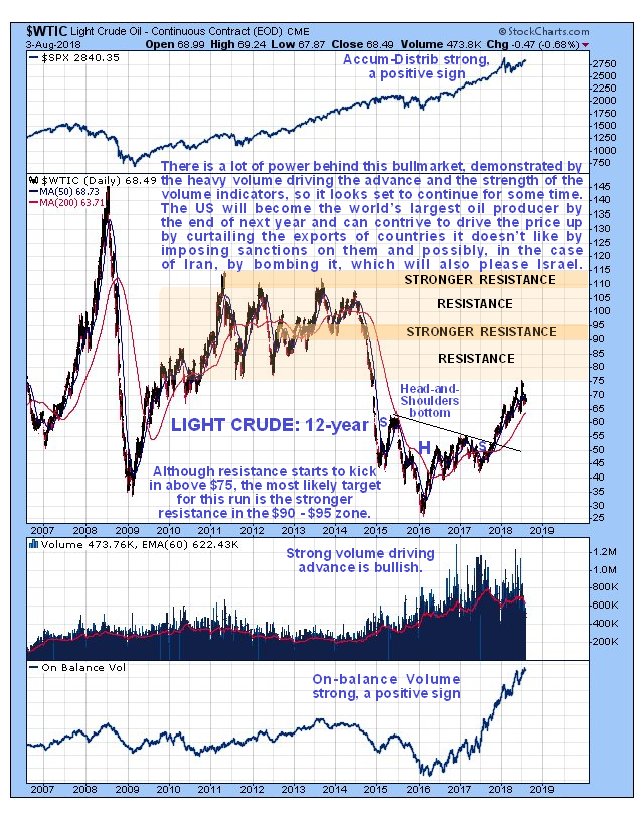

Oil Market UpdateClive Maund support@clivemaund.com August 8th, 2018 By the end of next year, the United States is set to become the world's biggest oil producer. Once you grasp this, you understand that it has an incentive to promote higher oil prices, both to further its own oil industry and to generate big fat profits for the oil majors and bulging bonuses for oil company executives. The potential downside of driving the oil price higher, from the standpoint of those in control, is that designated enemies such as Iran and Russia might also benefit from these higher prices. So the way to prevent that from happening is to subject them to sanctions and oil export restrictions, and fabricate justifications for doing so, so as the ludicrous accusations about Russia meddling in the election. An added benefit of the sanctions and oil export restrictions on out of favor states is that it restricts supply, driving the price up more, and of course a more extreme way of driving the price up perhaps to giddy heights would be to bomb Iran, which would certainly make Israel very happy. The ordinary US motorist facing stiff price hikes at the pumps can go fly a kite. The predictions made in the last Oil Market update posted on the site nearly 3 months ago, on 12th May (too long ago) turned out to be correct. We were looking for a near-term reaction and then an advance to new highs, and that is what happened, although it then proceeded to react back again during the first half of July and we will now proceed to consider the outlook. On the latest 1-year chart for Light Crude we can see that the reaction back during the 1st half of July was nothing out of the ordinary, and it has brought the oil price back down to support near to the lower boundary of the intermediate uptrend shown, which is expected to turn the price back up again, especially as moving averages are still in quite strongly bullish alignment and the earlier overbought condition has fully unwound, as shown by the MACD indicator. However, on this chart we can also see a restrictive Dome pattern forming whose origins can be traced back to late last September, which may prevent the next rally getting as high as the upper return line of the uptrend channel before it turns down again, and we can get a better perspective on this Dome pattern by looking at the 3-year chart, which puts it in the context of the entire bullmarket advance to date from the early 2016 low, following the severe "crush Russia" bearmarket that preceded it and resulted in a lot of oil workers in the States being forced into idleness.  Whilst the oil COT chart is not as useful as COT charts for other commodities, because it does make anywhere near such wild swings, it does reveal that Commercial short and Large Spec long positions are at relatively high levels historically. While they are not at levels that will necessarily prevent further gains, they put us on notice that should they climb to greater extremes a deeper reaction back will become more likely. A reaction back across the channel shown on the 3-year chart below would result in these readings easing to healthier levels.  Click on chart to popup a larger, clearer version.

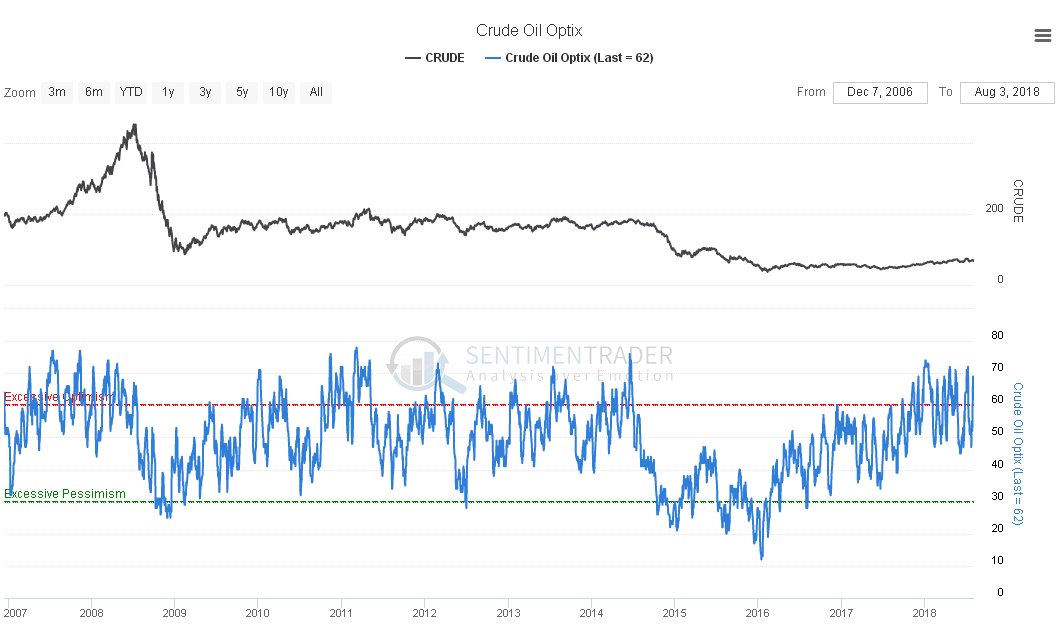

Click on chart to popup a larger, clearer version.On the 3-year chart we can see clearly why oil's latest uptrend is running out of steam here. In the 1st place this intermediate uptrend has been in force for about a year now without any significant correction, which is quite a long time. Secondly, it now appears to be at the top or apex of the Dome that we already saw on the 1-year chart, which could force it lower soon, although as mentioned above it could first make a run at the Dome boundary. Thirdly, we can see that a much larger potential channel exists, and it is viewed as no coincidence that the price is rounding over beneath a Dome pattern whose upper limits are roughly at the top of this channel. It could react back as far as the lower boundary of this large channel, currently at about $54.00, without damaging the long-term bullish picture. At this point a reaction this deep doesn't look likely, and it should be pointed out that oil's bullmarket could accelerate, since the origin of this channel is the low point of the giant base pattern, which means that it may be too shallow so that the oil price accelerates out the top of its requiring that a new steeper channel be drawn on the chart. Note also that these Dome patterns often only contain the price temporarily before it busts out the top into a new uptrend.  The very long-term 12-year chart gives us a most useful overall perspective. On this chart we can see the huge runup in the oil price during 2007 and early 2008 that was followed by a more dramatic selloff occasioned by the 2008 market crash. The price then made back a good portion of the losses caused by the crash, peaking again in 2011, and then chopped sideways for years before plummeting in 2014 in the "crush Russia" crash which was a concerted attempt by Saudi and the US to force Russia to the wall, which didn't work. What it did do is cause the price to drop to even lower levels than at the trough of the 2008 - 2009 market crash, resulting in thousands of US oil workers being thrown out of work. After this severe decline to a low level a downsloping Head-and-Shoulders bottom formed which the price broke out of into a new bullmarket just last Fall. Going just on price alone this new bullmarket looks rather anemic and like it may peter out and reverse into another bearmarket before much longer, and while we can expect this to happen if we see another 2008 meltdown, the heavy volume driving this advance and the resulting strong volume indicators suggest that there is a lot of power behind this bullmarket, which could take the oil price a lot higher if the general market crash that threatens holds off for long enough. With respect to this, it is now worth looking in some detail at how the oil price was influenced by the 2007 - 2009 general market crash, which we can do by looking at a chart for this timeframe with the S&P500 index added to it.  The chart for Light Crude for the 2007 - 2009 timeframe is most interesting as it shows truly extraordinary price gyrations of huge magnitude for this, the most important commodity in the world. During 2007 and the 1st half of 2008 the price ascended in a parabolic arc, peaking at about $147 in July of 2008. What is most noteworthy about this with respect to what is going on today is that oil was not deterred from ramping higher by the fact that a bearmarket had already become established in the broad stockmarket, as shown by the S&P500 index shown at the top of this chart. The stockmarket was already 9 months into its bearmarket by the time it negatively impacted the oil price, but after the oil price broke down from its parabolic uptrend and then below its 200-day moving average, it crashed along with the stockmarket. The takeaway from this is that an emerging bearmarket in stocks won't necessarily stop oil in its tracks, at least until it has been underway for some time and is approaching the crash phase.  Finally, the Crude Oil Optix, or optimism chart, shows that optimism is at the sort of levels that frequently lead to a significant reaction, and the look of this chart suggests a higher chance that Light Crude will react back across the larger channel shown on our 3-year chart, probably after 1st rallying up towards the Dome boundary.  Click on chart to popup a larger, clearer version.

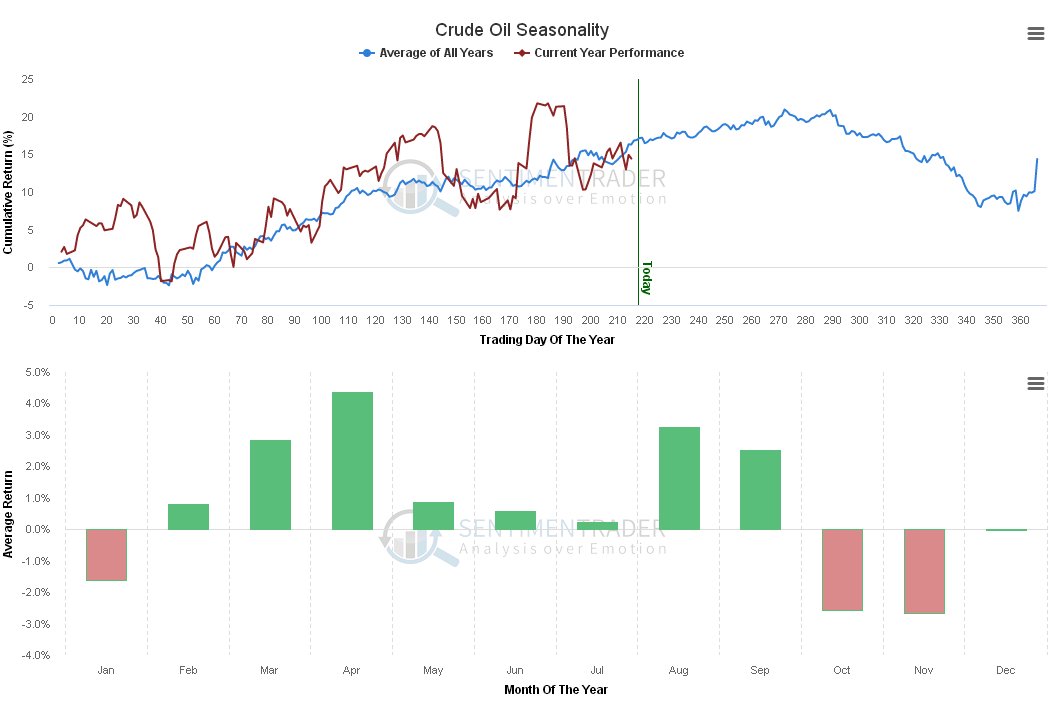

Chart courtesy of sentimentrader.com

Click on chart to popup a larger, clearer version.

Chart courtesy of sentimentrader.com

Click on chart to popup a larger, clearer version.

Chart courtesy of sentimentrader.com

Click on chart to popup a larger, clearer version.

Chart courtesy of sentimentrader.com

Clive Maund August 8th, 2018 support@clivemaund.com Clive Maund is an English technical analyst, holding a diploma from the Society of Technical Analysts, Cambridge and lives in The Lake District, Chile. Visit his subscription website at clivemaund.com .[You can subscribe here]. Clivemaund.com is dedicated to serious investors and traders in the precious metals and energy sectors. I offer my no nonsense, premium analysis to subscribers. Our project is 100% subscriber supported. We take no advertising or incentives from the companies we cover. If you are serious about making some real profits, this site is for you! Happy trading. No responsibility can be accepted for losses that may result as a consequence of trading on the basis of this analysis. Copyright © 2003-2017 CliveMaund. All Rights Reserved. |

| Home :: Archives :: Contact |

FRIDAY EDITION March 14th, 2025 © 2025 321energy.com |

|