|

SATURDAY EDITION April 19th, 2025 |

|

Home :: Archives :: Contact |

|

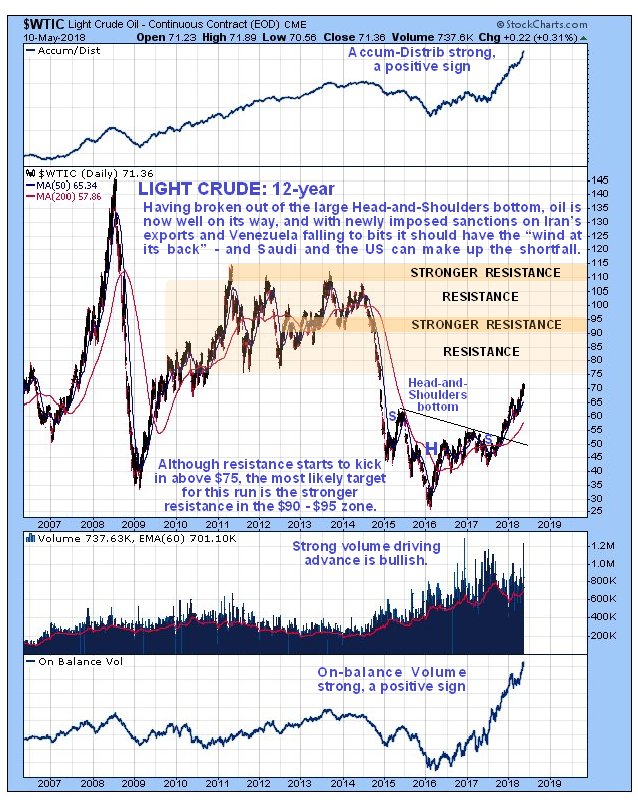

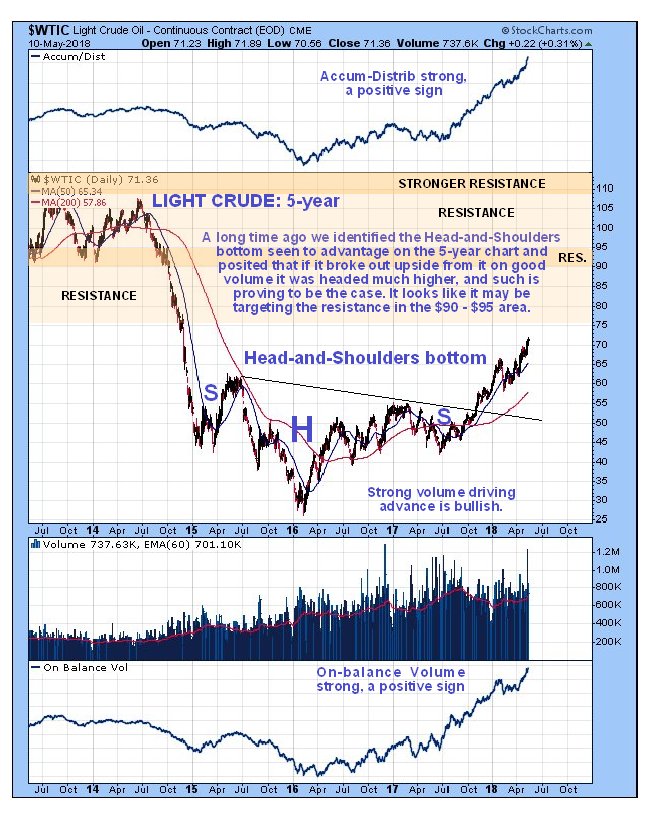

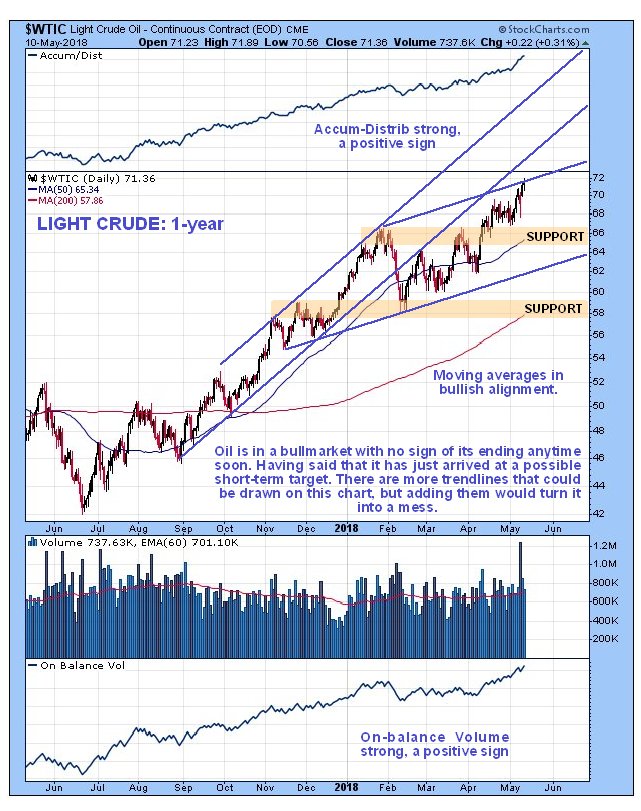

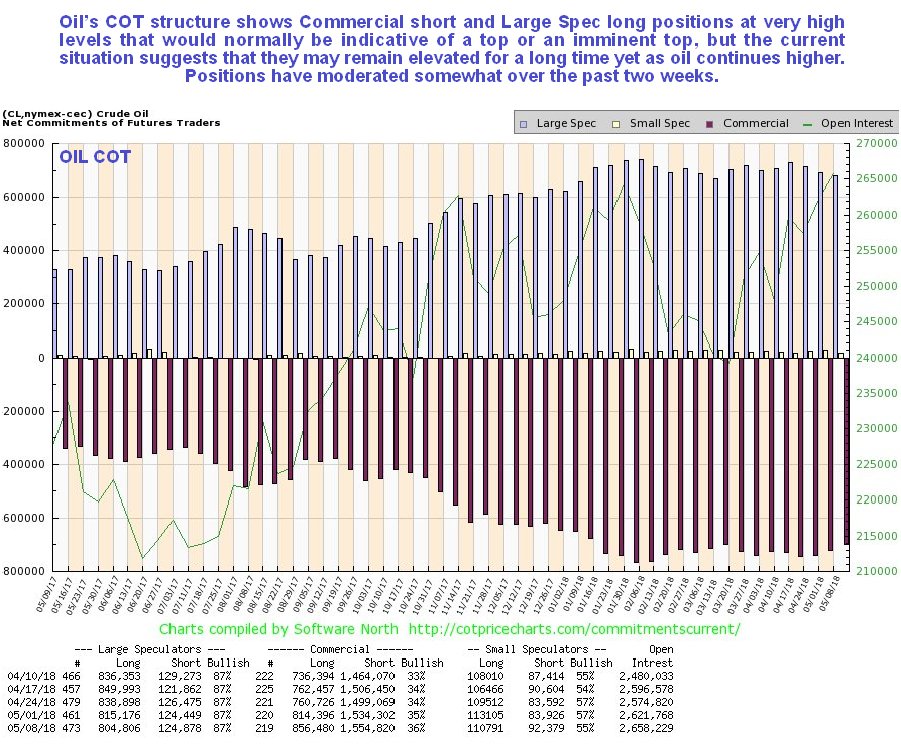

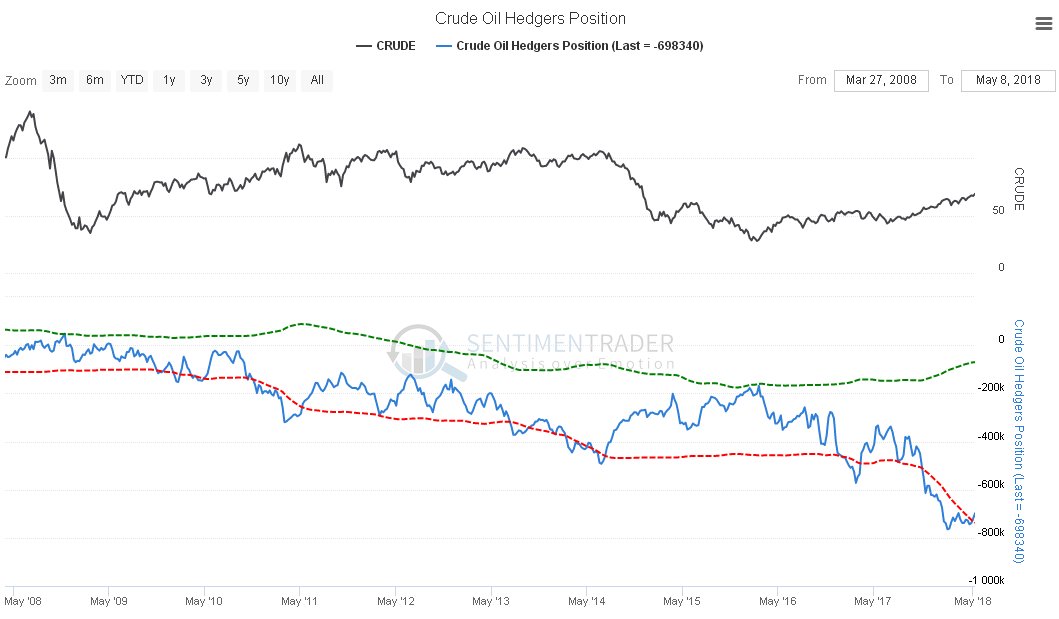

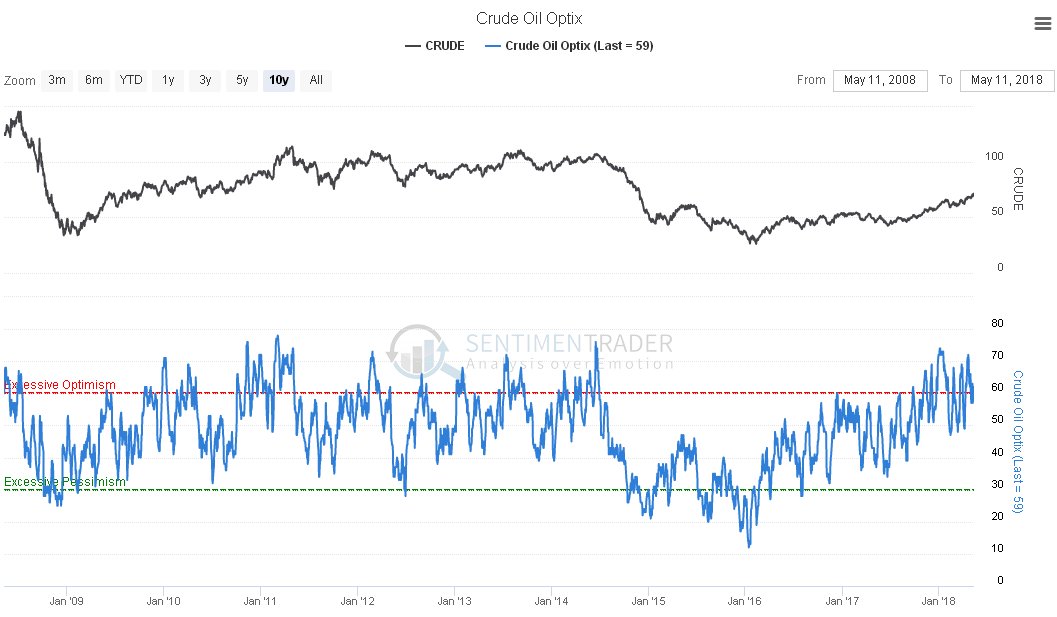

Oil Market UpdateClive Maund support@clivemaund.com May 14th, 2018 Oil is now in a bullmarket again, and those who have assumed the role of rulership of the world have manipulated the geopolitics to assure that the KSA (Kingdom of Saudi Arabia) and USA (United States of America) are the prime beneficiaries of the higher price, whilst those who are out of favor, Iran and Russia, are shut out - partially barred from selling at the higher prices due to being sanctioned. The reason that Saudi Arabia is favored is of course that it is a client state that is handsomely rewarded for maintaining the dollar payments system. Venezuela, which has had its economy wrecked, is out of the game. Here it is worth taking note of the fact that the US will be the world's biggest producer of oil by the end of next year, and for this reason will clearly be a beneficiary of higher prices, and stopping exporters who you don't like from exporting their oil is a simple way to achieve them. On the long-term 12-year chart for Light Crude we can see that it is advancing out of a large Head-and-Shoulders bottom that formed following the 2014 - 2015 plunge in the oil price. This chart is useful because we can see on it where the strongest resistance is centered, and while this will act to impede the advance and perhaps cause corrections, it won't necessarily stop it. This chart is also interesting as it shows the huge ramp in the oil price in 2007 and the first half of 2008, and how it was followed by the devastating plunge wrought by the 2008 crash, that at the time felt like "the end of the world". Before leaving this chart note the persistent heavy volume driving this bullmarket and the strongly climbing volume indicators, all of which suggests that it may have a lot further to run.  On the 5-year chart for Light Crude we can see the Head-and-Shoulders bottom in more detail, and in particular how the bullmarket actually started back last October with a breakout from the downsloping neckline of this pattern. We can also see that the price is starting the approach initial resistance above $75, although the resistance does not become strong until the $90 - $95 zone is reached.  We had correctly identified the Head-and-Shoulders bottom at the time back last October when the following chart was posted...  Zooming in further now, the 1-year chart provides useful perspective as it shows the bullmarket to date from where it started in detail. Contact with the upper boundary of the steep channel in January was what caused us to turn cautious on oil in the last Oil Market update back in January, and as we can see, it went on to fall sharply at the time the broad stockmarket plunged late in January and early in February. Since that reaction it has recovered well, before marshaling itself to break out to new highs for this bullmarket last month. Interestingly, it has just arrived at a minor target at the upper boundary of the less steep channel shown, which may lead to consolidation or a minor reaction, but overall this chart presents a very bullish picture of a major uptrend that looks set to continue and it is thought probable that it will take Light Crude at least to the $90 area before it's done.  The 6-month chart shows recent action in more detail and how Light Crude has arrived at the trendline target in an overbought condition on its MACD indicator, having opened up a quite large gap with its 200-day moving average. So we shouldn't be surprised to see a some consolidation or a minor reaction here, although the other strongly bullish factors that we have observed are likely to reassert themselves and get it moving higher again before long.  The latest COTs for oil look bearish, with high Commercial short positions and high Large Spec long positions, and while this is a setup that can inflict heavy damage at some point in the future, we should keep in mind that these high readings can persist for a long time as the price advances before the potential for reversal and decline becomes manifest. They have already existed since late January and have not stopped oil¡s advance since then. Another important point should be made here with respect to this - there appears to be a conspiracy in train to create and maintain a high oil price for the benefit of Saudi Arabia and the US, now a very big producer, which is an important factor behind Trump reneging on the Iran Oil deal, in order to reimpose sanctions on Iran so its former market share can be taken.  The latest Hedgers chart for oil also looks bearish, but for the various reasons discussed looks unlikely to derail the bullmarket in the foreseeable future.  Ditto the Crude Oil Optix, or optimism chart, although this does suggest that having hit a near-term target, oil may consolidate or react back modestly for a while, before continuing higher again, which would allow the optix reading (and other oscillators) to moderate.  There can be no doubt that the US reneging on the Iran Nuclear deal is unfair, because Iran was in full compliance with its requirements, and Trump's justification for it included assertions and statements that were flat out lies, and the unfairness of it is exacerbated by Iran then being punished by sanctions, despite having done nothing to deserve such treatment. The reasons for reneging on the deal, in addition to those discussed above, which are so that Saudi and the US can benefit from higher oil prices and cut Iran out, is to make Saudi happy by attacking and tearing down its arch enemy and big rival in the region, to make Israel happy too by weakening Iran, because Israel wants to eventually dominate Iran and thus the entire Mid-East, and to that end to lay the groundwork for possible military assaults on Iran for the benefit of Israel, using the US military, probably justified by "false flag" attacks like the recent chemical attack in Syria that was blamed on Assad. The fact that the treatment of Iran is unfair plays into the hands of its enemies, because if it gets angry and frustrated and lashes out, as appears to have just happened in the Golan, then that will provide the perfect excuse to give it a "bloody good hiding". Rather curiously, Russia appears to have tired of trying to save Syria and Iran from the predations of the Empire, and stood back while Israel has attacked them in Syria in recent days. Bibi - Benjamin Netanyahu - has even visited Putin in Moscow, and in addition to watching a spectacular military parade, which must have been fun, is thought to have been working on Putin to get him "on side" so that Israel can attack Syria and more especially Iran with impunity, although it remains to be seen how far Putin can be pushed. If Putin thinks that this rapprochement will "get Russia off the hook" with regard to the Empire's long-term plans for it, he is very much mistaken, for the Empire plans to take Russia down and subjugate it in due course, and after that, China. The reasons that the USA scuppered the Iran nuclear deal were actually 5-fold. First, a prime aim is to reimpose sanctions on Iran, in order to reduce its oil output, which will help to jack up the price which Saudi and US can then benefit from, with Russia also being cut out by sanctions. Second, its reduced exports will result in the country being weakened, making it easier to instigate a pro-Western Coup there. Third, weakening the arch-enemy of client state Saudi is a way of rewarding it for its fealty to the Empire and more especially the dollar. Fourth, it paves the way for a military assault on Iran by the US, on Israel's behalf, which brings us to the 5th reason. The 5th reason is this: in order to justify its inflated budget, the Military - Industrial complex in the US has to spirit enemies into existence out of nowhere, hence "The War on Terror" etc. David Stockman in his incisive piece Forget "America", "It's Deep State First" estimates that the US Military budget is about US$550 billion in excess of what is required to fulfill its stated purpose, which is to defend the country - that is US$550 billion that they are literally robbing from US taxpayers to line their pockets. But don't expect the man in the street, the "Goy Cattle" to complain or try to do anything about it - the Zionists are in this respect correct - they are simply too ignorant, insouciant and stupid to do so. They have been taught by Hollywood, which has a mutually beneficial cozy relationship with the Military, to worship the Military, and so in a way they deserve to be fleeced. Never forget that the key to bringing down the Empire is to destroy the dollar as the world reserve currency and the Treasury market, which together constitute a giant aorta that funnels the world's wealth into Washington, enabling the US to project power out of all proportion to its size and population. If the other countries of the world don't like being dominated by Washington then this is what they need to concentrate on achieving, and a coordinated effort would be a lot more effective, since a piecemeal approach would provoke a military onslaught as happened with Iraq and Libya. In saying this it is recognized that it would be difficult to get Europe on board, because leading politicians in Brussels are more inclined to be swayed by large brown envelopes stuffed with cash, than they are by their consciences. This was why the European Union was created in the 1st place, since it is much easier for the Neocons to control Europe as one entity than as a large group of independent states. Hungary is the one honorable standout at this time, as it built a huge border fence to keep the immigrants out and preserve its national identity and told the corrupt bureaucrats in Brussels to go **** themselves. With respect the longer-term outlook for the oil price, it looks like we have a fairly simple situation here. Saudi and the US are big producers, with the US set to become the world's biggest producer by the end of next year. They want as much of the pie as they can take and don't want their enemies benefitting from the higher oil price, so they will sanction Iran and Russia, using false pretexts, to restrict their production and thus keep prices high, and at the same time reducing their income from it. Thus, unless and until we see the economy cave in, probably preceded by a collapse in the bondmarket and soaring rates which is very possible, the outlook is for oil prices to remain firm and probably continue to advance. End of update. Clive Maund May 14th, 2018 support@clivemaund.com Clive Maund is an English technical analyst, holding a diploma from the Society of Technical Analysts, Cambridge and lives in The Lake District, Chile. Visit his subscription website at clivemaund.com .[You can subscribe here]. Clivemaund.com is dedicated to serious investors and traders in the precious metals and energy sectors. I offer my no nonsense, premium analysis to subscribers. Our project is 100% subscriber supported. We take no advertising or incentives from the companies we cover. If you are serious about making some real profits, this site is for you! Happy trading. No responsibility can be accepted for losses that may result as a consequence of trading on the basis of this analysis. Copyright © 2003-2017 CliveMaund. All Rights Reserved. |

| Home :: Archives :: Contact |

SATURDAY EDITION April 19th, 2025 © 2025 321energy.com |

|