|

WEDNESDAY EDITION January 7th, 2026 |

|

Home :: Archives :: Contact |

|

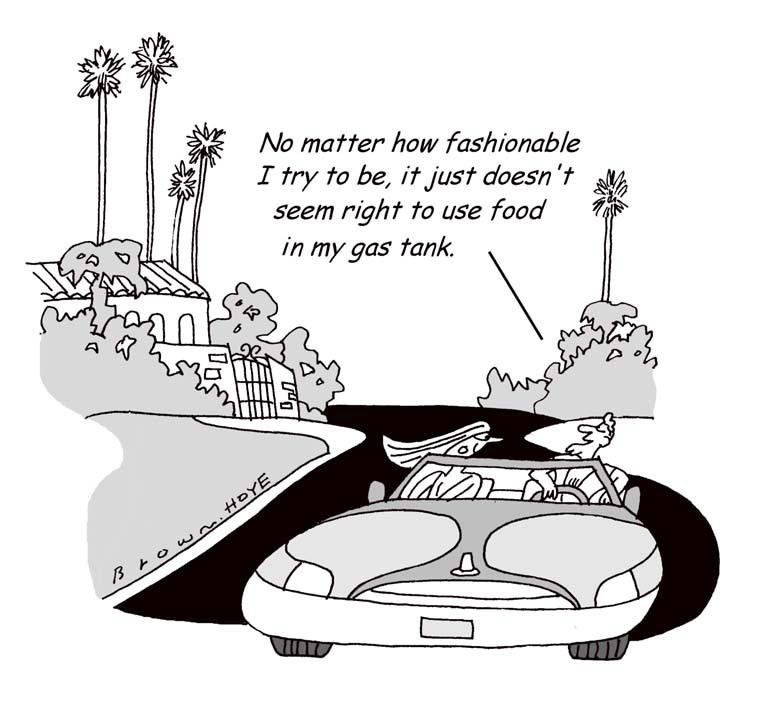

U.S. corn ethanol "was not a good policy" - GorePUBLISHED BY INSTITUTIONAL ADVISORS November 26th, 2010 Technical observations of RossClark@shaw.ca Is Al Gore becoming a neo-conservative? U.S. corn ethanol "was not a good policy" - Gore Mon Nov 22, 2010 12:24pm GMT U.S. ethanol consumes about 40 pct corn crop * Impact on food prices "real" By Gerard Wynn (Reporting by Gerard Wynn; editing by Keiron Henderson) ATHENS, Nov 22 (Reuters) - Former U.S. vice-president Al Gore said support for corn-based ethanol in the United States was "not a good policy", weeks before tax credits are up for renewal. U.S. blending tax breaks for ethanol make it profitable for refiners to use the fuel even when it is more expensive than gasoline. The credits are up for renewal on Dec. 31. Total U.S. ethanol subsidies reached $7.7 billion last year according to the International Energy Industry, which said biofuels worldwide received more subsidies than any other form of renewable energy. "It is not a good policy to have these massive subsidies for (U.S.) first generation ethanol," said Gore, speaking at a green energy business conference in Athens sponsored by Marfin Popular Bank. "First generation ethanol I think was a mistake. The energy conversion ratios are at best very small. "It's hard once such a programme is put in place to deal with the lobbies that keep it going." He explained his own support for the original programme on his presidential ambitions. "One of the reasons I made that mistake is that I paid particular attention to the farmers in my home state of Tennessee, and I had a certain fondness for the farmers in the state of Iowa because I was about to run for president." U.S. ethanol is made by extracting sugar from corn, an energy-intensive process. The U.S. ethanol industry will consume about 41 percent of the U.S. corn crop this year, or 15 percent of the global corn crop, according to Goldman Sachs analysts. A food-versus-fuel debate erupted in 2008, in the wake of record food prices, where the biofuel industry was criticised for helping stoke food prices. Gore said a range of factors had contributed to that food price crisis, including drought in Australia, but said there was no doubt biofuels have an effect. "The size, the percentage of corn particularly, which is now being (used for) first generation ethanol definitely has an impact on food prices. "The competition with food prices is real." Gore supported so-called second generation technologies which do not compete with food, for example cellulosic technologies which use chemicals or enzymes to extract sugar from fibre for example in wood, waste or grass. "I do think second and third generation that don't compete with food prices will play an increasing role, certainly with aviation fuels." Gore added did that he did not expect a U.S. clean energy or climate bill for "at least two years" following the mid-term elections which saw Republicans increase their support.  BOB HOYE, INSTITUTIONAL ADVISORS November 26th, 2010 EMAIL:: bobhoye@institutionaladvisors.com CHARTWORKS WEBSITE:: www.institutionaladvisors.com The opinions in this report are solely those of the author. The information herein was obtained from various sources; however we do not guarantee its accuracy or completeness. This research report is prepared for general circulation and is circulated for general information only. It does not have regard to the specific investment objectives, financial situation and the particular needs of any specific person who may receive this report. Investors should seek financial advice regarding the appropriateness of investing in any securities or investment strategies discussed or recommended in this report and should understand that statements regarding future prospects may not be realized. Investors should note that income from such securities, if any, may fluctuate and that each security’s price or value may rise or fall. Accordingly, investors may receive back less than originally invested. Past performance is not necessarily a guide to future performance. Neither the information nor any opinion expressed constitutes an offer to buy or sell any securities or options or futures contracts. Foreign currency rates of exchange may adversely affect the value, price or income of any security or related investment mentioned in this report. In addition, investors in securities such as ADRs, whose values are influenced by the currency of the underlying security, effectively assume currency risk. Moreover, from time to time, members of the Institutional Advisors team may be long or short positions discussed in our publications. |

| Home :: Archives :: Contact |

WEDNESDAY EDITION January 7th, 2026 © 2026 321energy.com |

|