|

THURSDAY EDITION March 12th, 2026 |

|

Home :: Archives :: Contact |

|

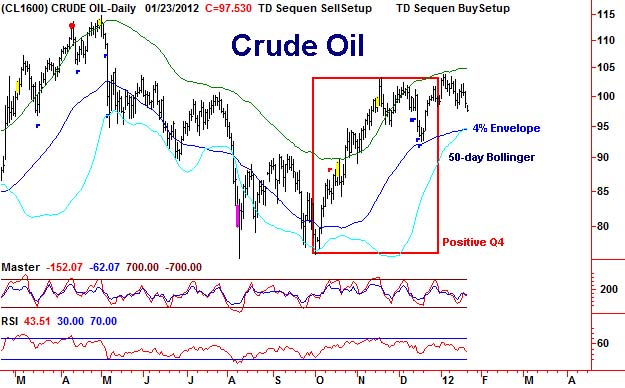

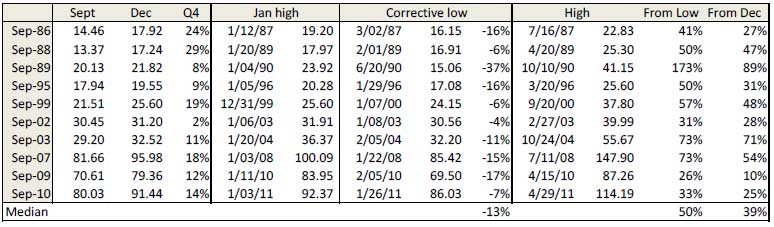

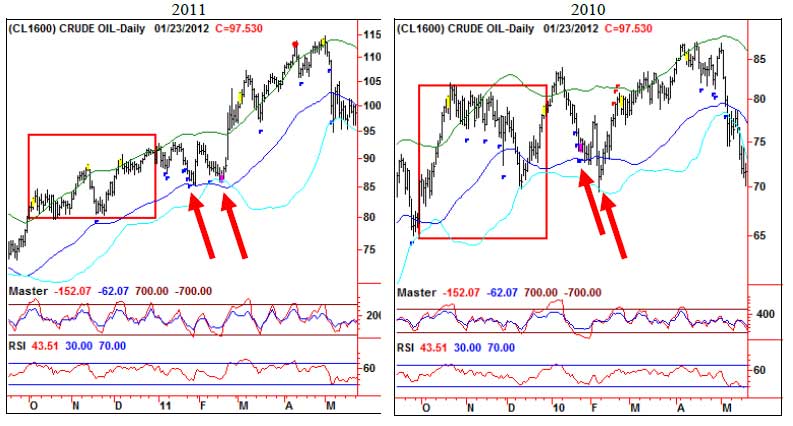

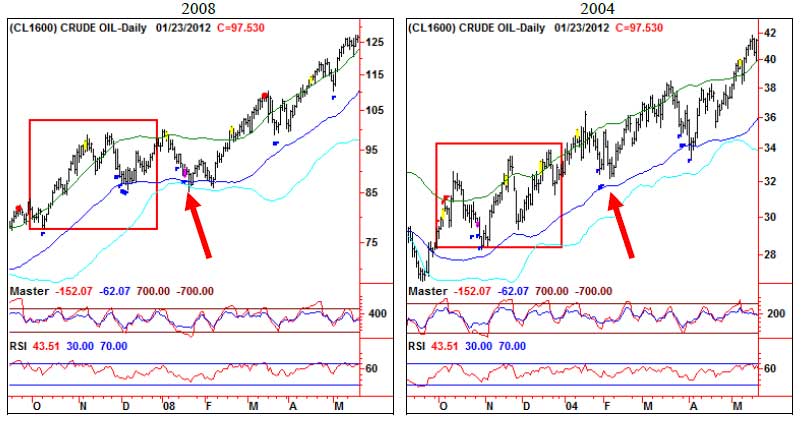

Crude Oil Correction Arrives on ScheduleBOB HOYE, INSTITUTIONAL ADVISORS January 27th, 2012 EMAIL:: bobhoye@institutionaladvisors.com CHARTWORKS WEBSITE:: www.institutionaladvisors.com Strong fourth calendar quarters in crude oil, as seen ten times since 1986, are followed by even higher highs in the following year, but only after a correction in January – February. Following last year’s positive fourth calendar quarter oil has established a customary high in the early days of January. As stated in earlier reports, look for support at the 50-day Bollinger Band (currently 94.70) ideally with an RSI(14) reading in the mid 30’s. Another key support following strong Q4’s is the 4% moving average envelope at 94.40 (4% below the 34-day moving average of lows). It was influential at the January – February lows of 2011, 2010, 2008, 2000, 1996 and 1987; close in 2004 & 1989 and ineffective in 1990 when the eventual low was generated in June. Each year that saw a positive Q4 was followed by a minimum advance of 10% in the next year and a median advance of 39%. From the corrective low, the minimum advance was 26% with a median rally of 50%.

Examples of declines to the Bollinger Band and Moving Average Band

BOB HOYE, INSTITUTIONAL ADVISORS January 27th, 2012 EMAIL:: bobhoye@institutionaladvisors.com CHARTWORKS WEBSITE:: www.institutionaladvisors.com The opinions in this report are solely those of the author. The information herein was obtained from various sources; however we do not guarantee its accuracy or completeness. This research report is prepared for general circulation and is circulated for general information only. It does not have regard to the specific investment objectives, financial situation and the particular needs of any specific person who may receive this report. Investors should seek financial advice regarding the appropriateness of investing in any securities or investment strategies discussed or recommended in this report and should understand that statements regarding future prospects may not be realized. Investors should note that income from such securities, if any, may fluctuate and that each security’s price or value may rise or fall. Accordingly, investors may receive back less than originally invested. Past performance is not necessarily a guide to future performance. Neither the information nor any opinion expressed constitutes an offer to buy or sell any securities or options or futures contracts. Foreign currency rates of exchange may adversely affect the value, price or income of any security or related investment mentioned in this report. In addition, investors in securities such as ADRs, whose values are influenced by the currency of the underlying security, effectively assume currency risk. Moreover, from time to time, members of the Institutional Advisors team may be long or short positions discussed in our publications. |

| Home :: Archives :: Contact |

THURSDAY EDITION March 12th, 2026 © 2026 321energy.com |

|