|

MONDAY EDITION March 31st, 2025 |

|

Home :: Archives :: Contact |

|

High Noon for Natural Gas[2004, Chelsea Green Publishing Co, ISBN 1931498539]

By Julian Darley Courtesey of www.sandersresearch.com Non-renewable resources are naturally a hot topic worldwide given their fundamental importance to the way we live. Oil is probably the primary non-renewable resource that springs to mind. We assume it is the most widely used and consequently the most at risk from depletion. Julian Darley suggests otherwise. While oil is set to run out before gas, it is equally clear that gas is following the same pattern of discovery but is roughly 40 years behind. As oil is set to peak soon—if not already—its price has skyrocketed along with gas regarded as a substitute. Perhaps its very invisibility makes gas depletion seem less of an issue. So Darley’s main purpose is to raise awareness of peak gas and to that end is full of sho cking facts and straight to the point information. His core point is the widely ignored carbon chasm; increasing fossil energy demand and dwindling supply; and the problems faced when that supply is exhausted. Darley begins with the common uses of gas such as synthetic fertilizer. The well-known consequences of which have been massive population growth and serious damage to the natural productive capacity of the soil. Natural gas is also widely used to keep America warm in winter and cool in summer with electric air conditioning. So Americans have become accustomed to a more moderate, artificial climate. Should this change suddenly without sufficient notice, the death toll could be high. So why are gas supplies finite? The formation of gas takes millions of years under specific conditions; so, as far as we are concerned, it is non-renewable. The production curve of gas is completely different from that of oil. Due to the restriction of the pipes through which the gas must flow, there is a limit on how much can be produced. On the other hand, the market for oil is fast-paced and its production curve reflects that: a bell-shaped curved whose top or peak occurs when the oil has been half depleted. The slower production of gas can be seen in a curve that flattens off. This means there is no defined gas peak but it also hides the warning that the system is about to decline. The producer has little or no warning of when his reserves will run out; and once gas begins to decline, it is a rapid and difficult process to reverse. This does not occur only on a local level, but is true for global production as well. The curve looks exactly the same. Therefore it is i mpossible to predict the exact timing of a global gas production peak.

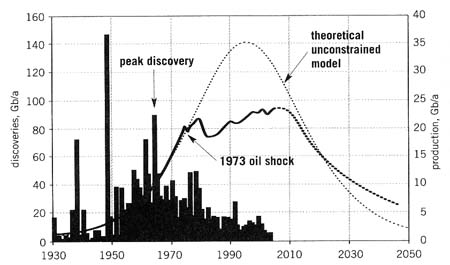

"World conventional oil discovery, with actual and unconstrained production, past, present, and future. The black bars show discovery; the dotted line shows how production would have behaved without the 1970s oil shocks; the solid line shows actual production, and prediction. Source: Colin Campbell." Page 124 The author makes it clear that in addition to the masked decline, the extent of global gas reserves is unknown. Politics has no small role. One could say that gas is a “political substance” so it is very difficult to learn the truth about the quantities available. There are usually two versions of how much gas is left in a given country: the government’s version which is public, and the petroleum geologists whose technical findings are kept secret. Governments are inclined to inflate gas reserves to strengthen their bargaining position while corporations downplay their reserves with an eye on reduced tax and avoiding bidding wars. Darley briefly explores the different types of gas and where they come from and highlights the problems of extracting gas whichever form it takes. Unconventional gas, for example, such as coal bed methane produces large amounts of toxic wastewater. The two main methods of transportation, by liquid natural gas (LNG) tankers or pipelines also have their detractors. LNG has to be cooled to a temperature of minus 160ºc which requires massive amounts of energy and is therefore consuming much of the energy it is trying to transport. On a LNG tanker, 1.5 to 2.5 cubic feet per 1000 cubic feet of gas is converted back into a gas form each day. Converting gas into a liquid and reverting it back again is hazardous to the surrounding areas of production. Liquidizing and shipping gas is a relatively recent proposal and will not be online until at least 2006. It will take anywhere from 3-7 years to get it confirmed and then built, by which time the author believes it will be too late and the massive investment will be wasted. Simply put, there will not be enough gas in the world to transport. The alternative, pipelines, are also very dangerous; there have been instances where pipelines have exploded killing many; polluting the atmosphere and increasing the ozone layer problem.

"World oil and gas discovery and production (called demand here), with predictions according to ExxonMobil. The only real difference between Exxon and the 'peak' petroleum geologists, at least one of whom used to work for Exxon, is that oil demand cannot continue as projected. Source: ExxonMobil." Page 124 Japan, Korea and Taiwan are rapidly being overtaken by China and the USA as the largest consumers of gas. Gas reserves in Canada, the North Sea, Russia, and South America are in their last stages, little more gas will be found there. However the Caspian Basin, the Persian Gulf, Iran, Qatar, Saudi Arabia, Kuwait, Iraq and Africa have all reported substantial quantities of natural gas. It is likely that as gas becomes scarce these areas will be exploited by gas-starved economies. Many of the future’s problems will boil down to energy security. The Middle East has had decades in which to arm itself, whereas Africa with so many separate countries is unlikely to be able to act effectively to protect its reserves. In his final chapter, Darley suggests both major changes for the whole world as well as small changes we can act out every day of our lives to alleviate the coming oil/gas crisis. Prices we are paying at the moment do not reflect the coming shortages. Huge demand and small supply will cause prices to soar. Price, which should act as an indicator, is failing to do this. Why? In a word: monopolies. These large companies conspire to addict the public to an abundance of cheap energy. They care nothing for the environment or rather anything much apart from profit. Darley’s ideas include radical steps such as: reducing population and economic growth as, in his view, we have grown beyond the earth’s capacity, and the earth cannot cope much longer. He urges a reduction of gas use in the four main areas: heating, plastic, power and food; and preferably a complete stop in the use of nitrogen fertilizers. More generally, we are advised to down size; start using less of everything. Everything has to come from your local communities, have your families and close friends just that – close; as it will be expensive and hard to see them in the future if they live far away. We need to re-localize, have everything we need to survive close to us so we can walk to get it. But most of all we shouldn’t give up, just keep trying. Start by telling everyo ne you know the stark result that will occur if they do not begin to take action now. He warns us not to give up, because we just don’t have time.

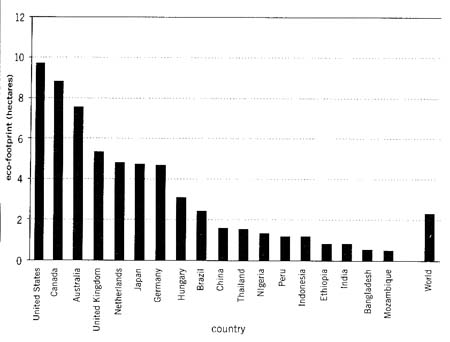

"Percapita ecological footprints of selected countries. Souce: Worldwide Fund for nature 2002." Page 197 High noon for natural gas is a detailed and informative book that concludes by warning us that unless the majority understand the dangers and act now we will wait too long – it is only when it is thought that we have gone too far that we will begin to act. It is high noon for natural gas, and unless we act soon it will be high noon for humans and maybe the planet as well. Ms Deborah Frith is the SRA Junior Intern for 2005-06. Courtesey of www.sandersresearch.com |

| Home :: Archives :: Contact |

MONDAY EDITION March 31st, 2025 © 2025 321energy.com |

|