|

MONDAY EDITION March 9th, 2026 |

|

Home :: Archives :: Contact |

|

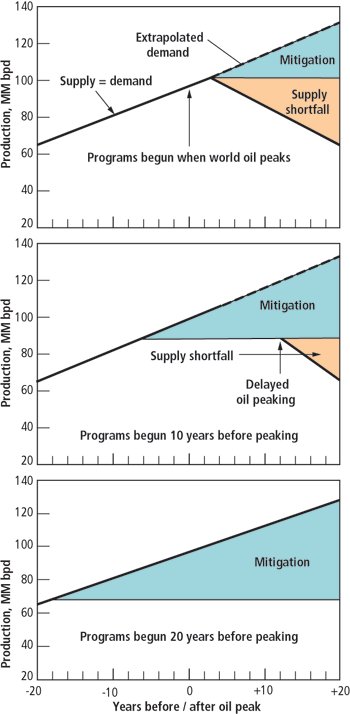

ASPO-USA's Conference Will Discuss Peak OilDavid CohenSeptember 26, 2007 Legendary oilman T. Boone Pickens, who correctly predicted that oil prices would exceed $80/barrel in the 4th quarter of 2007, will be a featured participant at ASPO-USA's 3rd annual World Oil Conference in Houston (October 17-20). Current high oil prices, which have followed a bullish trend for over 7 years now, may signal that the world is approaching the peak of world oil production sooner than some predict. Select here to learn more about the Houston World Oil Conference. The American branch of the worldwide Association for the Study of Peak Oil & Gas (ASPO) is this country's "official" group investigating peak oil, its consequences, and steps that might be taken to mitigate the problem when it occurs. Peak oil is defined as the historical high water mark of global oil production, analogous to the U.S. peak of 11.673 million barrels per day which took place in 1970. American production has gradually declined ever since, making the country more and more dependent on imported oil.  No one doubts that world oil production will eventually peak and decline, so the only real issues are the timing and consequences of this event. ASPO-USA's analysis leads them to conclude that peak oil is likely to occur in the medium-term before 2015. This "imminent peak" scenario is contrary to other findings like those presented to this year's AAPG meeting by Richard Nehring, chairman of the Hedberg Research Conference on Understanding World Oil Resources. Nehring believes oil production will peak—actually, plateau—sometime between 2020 and 2040 (graph left). Nehring will join other distinguished ASPO-USA participants in a peak oil dialogue called A World of Plenty or Constraint? on Thursday evening following that day's speaker presentations. Others optimists, such as Cambridge Energy Research Associates (CERA) head Daniel Yergin, who thinks the world's oil production peak won't arrive until 2035, declined invitations to debate future oil supply issues at ASPO-USA's conference. Stephen B. Andrews, a Denver energy consultant and co-founder of ASPO-USA told AAPG Explorer in 2006 that he anticipates a global peak within 10 years, but does not think that oil production will necessarily decline precipitously thereafter. "In scenario planning, I really think you have to pick a certain date. I pick 2015. There's nothing certain about that, except the date. We're going to get there," Andrews said. ASPO-USA analysts do not believe that we are "running out of oil" as CERA's press release put it on November 14th, 2006. They do think the world is running out of cheap oil, an opinion which is now widely shared even by those who do not subscribe to an imminent peak. Nor does ASPO-USA necessarily believe that the peak is inevitable when half the world's reserves have been consumed. This conjecture, which is usually associated with the mathematical methods used by legendary geologist M. King Hubbert to correctly estimate the 1970 peak of U.S. lower-48 oil production, assumes that the world knows with some certainty what the world's recoverable reserve volumes actually are, and that the producing countries will extract their oil in an unconstrained way. Concerning ongoing arguments about the size of the world's conventional (and unconventional) oil reserves, ASPO-USA believes it is more important to look at available oil flows, not untapped reserves volumes. "It's the size of the tap, not the size of the tank" that matters, explains Andrews. Moreover, so-called "aboveground" factors such as OPEC policies, resurgent oil nationalism, access restrictions on international oil companies, oil industry inflation that hampers investment, and geopolitical conflicts are just as important for peak oil theorists as the geological limits on production that accompany reserves depletion. ASPO-USA also does not necessarily subscribe to the view that the world's production peak has already come and gone. Some observers hold this position, pointing to the fact that the U.S. Department of Energy data show that average yearly production, including crude oil, condensate and natural gas liquids, has fallen each year since 2004 (including preliminary numbers through June, 2007). Still, the peak oil study group is concerned about this disturbing trend, which demonstrates that the producing countries are struggling to hold the line on oil output. Both Andrews and Randy Udall, another ASPO-USA co-founder, believe a more cautious approach emphasizing uncertainty about the future oil supply is warranted, in part because some analysts made premature peak oil forecasts in the past. But all predictions—including the sanguine ones made by CERA, ExxonMobil and others—contain inherent risks and uncertainties. If confidently optimistic forecasts are wrong, the risks are higher than if peak oil occurs a few years later than ASPO-USA expects—for example, in 2020 according to Nehring's low resource case scenario.  ASPO-USA thinks the better gamble is to prepare now for the inevitable peak in world oil production rather than run the risk of being caught off guard when it happens. Talking about America's approach to energy, James Schlesinger, the first Department of Energy secretary, said "we have only two modes — complacency and panic." Preferring neither, ASPO-USA works to awaken the public and policy-makers to the potential economic difficulties the U.S. will likely face when the peak occurs. An educated citizenry and enlightened policies, the group believes, can make the changes necessary to decrease America's risky oil dependency. No one can say exactly what the economic consequences of peak oil will be, but some studies indicate the prognosis is not good unless we address the problem soon. Robert Hirsch, Roger Bezdek and Robert Wendling, authors of Peaking of World Oil Production: Impacts, Mitigation, and Risk Management, a report published in February, 2005 for the U.S. Department of Energy, believe— A peak in world oil production would subject the world to its first-ever sustained discontinuity in energy - a commodity essential to the functioning of the world economy. A number of knowledgeable experts forecast that peaking of conventional oil production will occur sometime within the next 20 years. Given today's oil demand levels and usage patterns, such a forced disruption would have severe negative impacts on the economies of all oil-importing nations, perhaps the exporting ones as well. Viable mitigation options exist, but the timing of their implementation will be critical. The graph above (and quote from Mitigating a long-term shortfall of world oil production, World Oil Magazine, May, 2005) shows predicted global supply shortfalls if appropriate mitigation actions are not taken sometime prior to the peak of world oil production. If responses are begun 10 years before the peak, the world would still suffer oil supply shortfalls. Thus the timing of peak oil is crucial. Hirsch, the DOE report's lead author, will speak at ASPO-USA's upcoming conference and participate in the featured Plenty or Constraint? panel. The Houston World Oil Conference will be ASPO-USA's third meeting, and follows successful get togethers in Denver in 2005 and Boston in 2006. Other featured speakers include Houston Mayor Bill White (former U.S. Deputy Secretary of Energy), Peter Tertzakian (author of "A Thousand Barrels a Second"), Matthew Simmons, (author of "Twilight in the Desert: The Coming Saudi Oil Shock"), Henry Groppe of Groppe, Long & Littell, Arthur L. Smith (Houston business leader, formerly head of John S. Herold), Commissioner Elizabeth Ames Jones of the Texas Railroad Commission, Chris Skrebowski of London's Energy Institute, Charles Maxwell of Weeden & Co., David Hughes of the Canadian Geological Survey and Jeremy Gilbert of Barrelmore Ltd. (recently retired Chief Petroleum Engineer for British Petroleum). Also featured is a set of round-table sessions called Smart Money & Peak Oil discussing investment strategies for both conventional and unconventional energy resources. ASPO-USA's October conference presents a unique opportunity to separate fact from fiction in the peak oil debate. The smart money, including T. Boone Pickens and others, will be there. Don't get left behind. David Cohen September 26, 2007 |

| Home :: Archives :: Contact |

MONDAY EDITION March 9th, 2026 © 2026 321energy.com |

|