Oil Pricing, Shale Formations, Smart Companies & Taking Advantage

Written by Keith Schaefer & Michael Campbell

June 30th, 2011

email: zurrermoneytalks@shaw.ca

http://www.moneytalks.net/index.php

Michael: Very pleased to welcome back to the show Keith Schaefer with me he is the publisher of the oil and gas investments bulletin.

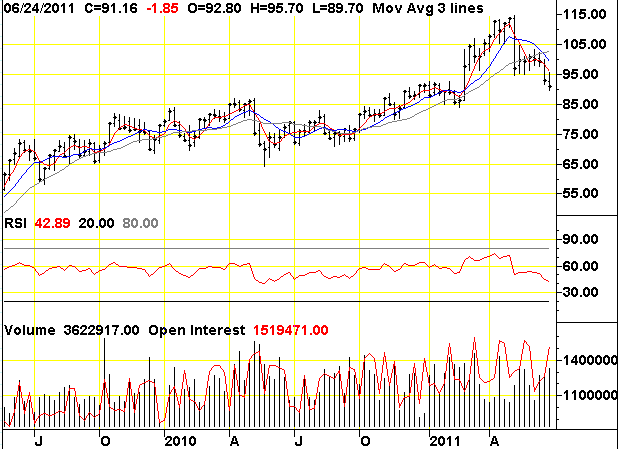

We will go over your individual stock recommendations, but first the big news coming out in the latter part of the week was the IEA releasing 60 million barrels from the strategic reserves. We saw oil taking that as an excuse to drop. But 60 million barrels is what, five hours consumption in the world?

Keith: Yes that's about it; it's actually about 17, 18 hours but certainly less than a day. So it was a bit of a head scratcher as to what they were thinking with that amount of fuel being released, because really it truly is a drop in the bucket fundamentally.

Michael: Did that release just provide an excuse for Oil to trade off in the direction it was moving at that point anyways?

Keith: Well that was my initial reaction. I think if you try and make sense of what they were trying to do here, they were trying to act towards speculators. Politically Obama has said that the speculators are becoming a problem again, that they are increasing the price of oil more than it should be which is hurting the average American. You know a great flag waving statement. So the number of long contracts had gone down the price of oil had gone down. It was a perfect time to do a little pre-emptive strike and just shake the market out.

All the speculators who were still long a bit would get nervous, and it was interesting that they only did that small amount because the street has been saying for fundamental reasons they are not going to do that again. I could see them doing this several times again over the next year because it is such a small amount it doesnít really affect anybody's strategic reserves. The United States' portion of this strategic reserve release was probably 3% or a little bit less of what they keep in their strategic reserve so it's not a big deal. So if the traders know that at any given time there's going to be a coordinated action in the market to put down the price of oil that is going to give them a little bit more caution in deciding how big a bet they are going to make in the oil speculative market. I am thinking that might be their thinking.

Michael: Only 60 million barrels and they got a $5 reaction at one point in the day. Every investment is a speculation, if somebody buys a Bell Canada what they are speculating on is future earnings and when you buy oil at this price youíre speculating it will go up. What should the Oil pricebe if you just looked at the fundamentals , the supply and demand right now?

Keith: Well mine would be lower but not a lot lower. I know there is other people there who are talking $30 lower, I would say probably $15 lower but thatís obviously a very difficult number to think about , the reality is that oil demand is going higher, the mount of spare capacity in the world therefore is going lower and so weíre getting closer and closer to the worldís true ability to produce as much oil as we need and of course thatís not a geological issue thatís apolitical issue.

Michael: Itís very interesting, but I mean when we got into that 110, 120 range for oil clearly a lot of that froth was about worry about North Africa, that weíd get a supply disruption. So sometimes itís good to at least have a marker as I say where current supply demand would be to sort of at least get an estimate of how much is really being added in anticipation of other things.

Keith: Yes and itís interesting because most of these strategic reserve release was truly geared towards Europe and Asia where there is lots of demand, and in North America where there is so much supply we are absolutely drowning in oil on this continent right now.

Michael: Looking at some of the storage problems they have for oil etcetera, people are having trouble wrapping their heads around that we are absolutely a wash in oil in North America.

Keith: Yes and the main reason for those is because of a lot of the Shale oil thatís being developed down in Texas and North Dakota in the Bakken and all these new conventional reserves are getting a new life with all the horizontal drilling. Shale gas, the Shale oil technology thatís being developed and the big problem is that there is no pipeline no major pipeline out of the major US oil storage space which is in Oklahoma. For some strange reason the Americans put the major oil holding place in the middle of the country not down in the coast where it has access to shipping. So there is no pipelines out of there and all the tanks theyíre actually about 86% full and itís going higher. So itís going to be very interesting to see what happens over the next few months as oil production continues to increase in the states. Oil production has not increased in the states for 30 years up until about last year.

Michael: I am a long term bull and I think you need exposure to the oil market. What's the bottom line on Oil, should we look at corrections as an opportunity to get involved?

Keith: Absolutely there is a strong bid under the price of oil for the next couple of decades because of the Asian industrialization story. Nothing has changed there, there is going to be ebbs and flows but the reality is that demand for hydrocarbons is only going to get greater. The worlds political situation and just the fact that we all have to get along and make a decisions together means that those things take a long time and so the infrastructure to get that oil to the market is going to create a constant bid under the price of oil for the next 20 years.

Michael: Letís talk about varying investments. How price sensitive are Junior exploration companies, mid-tier producers and senior producers to the change in the prices of oil?

Keith: You will find that the intermediates have the best data towards the oil price, towards the underlying commodity. The juniors have had a very interesting ride lately, in that as the oil price went from $100 to $120 a barrel and the juniors actually went down. They had an inverse relationship which I have never seen that in any commodity market before. Really what the market was saying is weíre pricing in a recession and so weíre selling our risky assets and that was our first indication that the price oil at $110 and $120 a barrel was unsustainable. They were kind of a canary in the coal mine. So now that oil is coming back down to $90 the value button is being reset on the juniors and I think they are getting ready for another run.

Michael: With Juniors companies, what are you looking for?

Keith: I am looking for a couple of things, one is I would love to see a management team thatís already built and sold a producing junior and the other thing that I am looking for is a company that has a large land position around a new discovery. With these new Shale plays, what they are finding is that they are actually fairly consistent over large area so, what happens is if one discovery well gets made in the Shale play the market is much more willing to price in future growth very quickly. Much more than they ever did in the old style of deposit.

Michael: It is all geology in the end is it not. What you appear to be saying is that if somebody, for example, has a simple one acre lease and the geology is correct for oil and gas then you know the chances are very good of the structure extending beyond that one acre claim and into a broader area.

Keith: Yes, much more so then ever before. Its analogous to potash in Saskatchewan where it goes for hundreds of miles and itís very consistent. The new Shale plays arenít quite like that but theyíre close. They have that style of consistency over large areas and you can have big area plays in oil and gas now because of that.

Michael: You follow a huge number of companies, can you tell me about of a couple of situations that we can put on our radar screen?

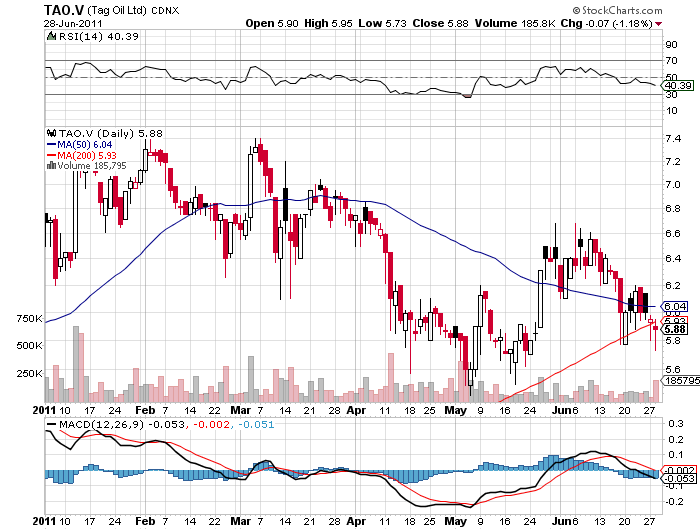

Keith: Sure one of my favourites right now is a company called Tag Oil (TAO.V on the TSX.V) that has gone into New Zealand. They have an unproven management team which is why we were able to buy the stock so cheaply a little over a year ago. Nobody really knew them but what they did was go in and they've gone from about 300 barrels a day for oil up to where they will be doing almost 5,000 barrels a day by the end of this August, September. They have been able to use new horizontal technology in an area where it hasnít been used before, on the North Islands of New Zealand and discovered a lot of oil and gas. What they have discovered over the last three to four weeks, with the different flow rates they have announced on four different wells, it would take them from 1,000 to 4,000 barrels a day in the next few months. Those are the type of stories to invest in, where the geological risk is gone. They have discovered the oil they are just waiting to bring it on stream now and thatís a great opportunity for investors to basically get a low risk entry point in that type of stock.

Michael: Especially if you can catch it in a down market I would think that provides even a better opportunity. I like the idea of it producing and once itís in the production mode you've taken out the exploration risk out and you protect yourself a little bit. Any other name for us?

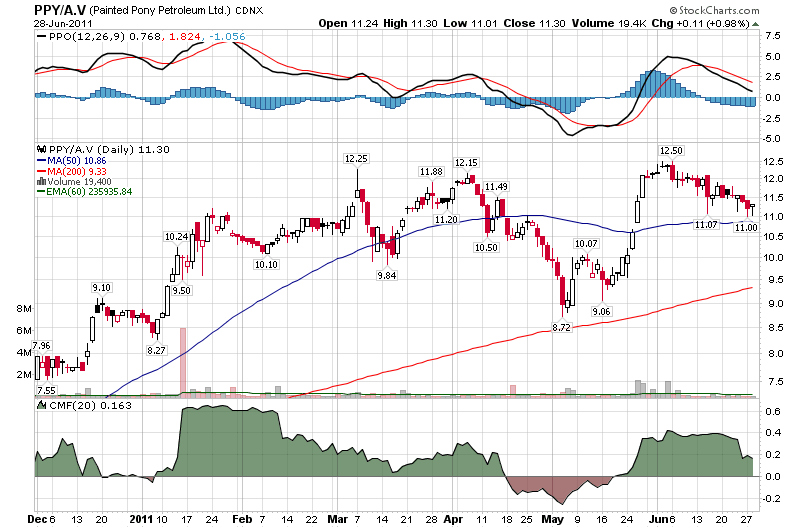

Keith: Locally here in Canada there are a couple of plays that I really like and they are both Bakken plays. A company called Painted Pony (Painted Pony is PPY.A http://www.paintedpony.ca/on the TSX) and their management team has done an unbelievable job in assembling two land packages. One oil play in the Bakken where theyíve got a lot of land and probably three to four years worth of low risk drilling to do, and gas up in the Montney gas play in north east BC where they have just a huge land position. They have been very successful in developing it, each quarter they are increasing production like clock work and the stock is always expensive. But I like expensive stock, that means the Street likes the team and will always reward them.

Michael: Are there any mid-range stocks, perhaps significant juniors that you think are just about to enter the mid-range, or a mid-range about to move to the senior sector?

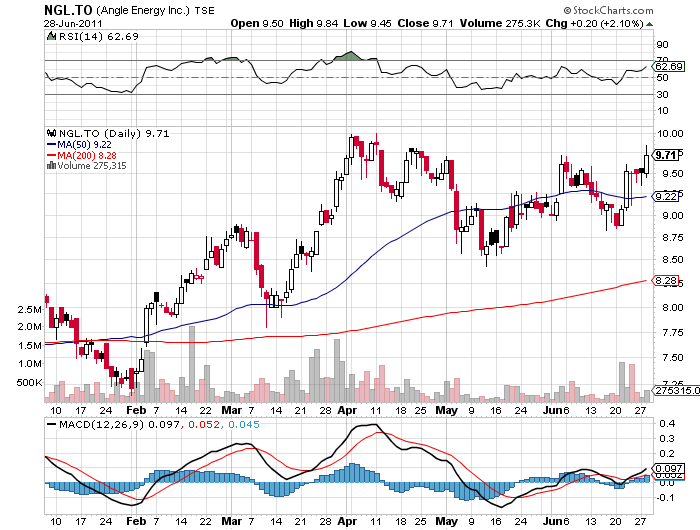

Keith: Well a few of the juniors that are just busting through that 10,000 barrel a day to 15,000 barrel a day range where they go from being a junior to an intermediate. One is called Angle Enery, NGL on the TSX). They are a very profitable gas company, one of the best gas companies. They have a lot of liquids in their gas which is things like butane that goes into your bic lighter and propane that goes into your barbeque, value added gases that really increases their profitability.

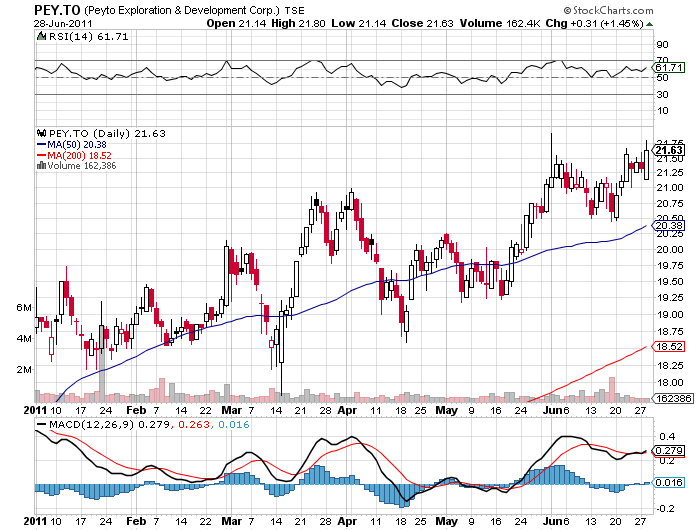

I have to say my favourite company is probably a company called Peyto (PEY on the TSX), they are the lowest cost producer, they are the fastest growing. That team has the best cost structure, their discipline and their management is just second to none in the business.

Michael: I want everyone that Keithís has offered Moneytalks his latest report. Just go to www.moneytalks.net or just click on this title "How the IEA Announcement Could Affect Junior Oil Stocks".

Keith, you mentioned the Bakken play and I wanted just to give an out line of the Bakken possibilities. I think itís a play that people should be aware of.

Keith: The Bakken has turned into the biggest discovery in North America in decades. It boarders the North Dakota/Saskatchewan border and when it first started getting developed about ten years ago everyone thought it was huge, that they could recover as much as 4 billion barrels of oil, which is a lot of oil . Now that number us up to almost 24 billion barrels, so the industry has done a great job very quickly, very efficiently stretching the boundaries and figuring out ways to get more and more oil out of out if each individual Bakken well. So thereís lots of Canadian juniors that are on both sides of the border and actually the report thatís on your website for your listeners is one of my favorites. A little junior company.

Michael: Interesting, Keith thank you so much for taking the time with us today.

Written by Keith Schaefer & Michael Campbell

June 30th, 2011

email: zurrermoneytalks@shaw.ca

http://www.moneytalks.net/index.php